While text ads can be filtered down to a few core optimization processes, like writing better ads or adding new keywords, Google Shopping is a much broader optimization skill. It is most comparable to landing page optimization. Yes, you can implement best practices, but beyond that, it’s a lot more open to interpretation.

Here are a couple of examples of broader optimization tactics for Google Shopping:

- Show bestsellers first or products on sale?

- Generic vs. brand searches?

- Optimize the feed.

- Remove product variants.

- Focus on Private Label products.

- Track profit to allow more profitable products to be prioritized.

- Run inventory levels to exclude products low in stock.

- Build a custom product score.

With Google Shopping, the sky is the limit.

None of these actions are similar to testing ad copy.

This article distinguishes between day-to-day clear-cut optimization tactics and bigger-picture optimizations.

Note: For the optimization of Smart Shopping/Performance Max campaigns, see a separate article.

Day-to-Day Google Shopping Optimizations

There are some things you can actively make changes to using Google Shopping:

Major areas:

- Bid management

- Negative keywords

- Feed improvement

Minor areas:

- Budget management

- Product exclusion

- Audience layering

Yes, budget and audiences are important, but they are not really optimization tactics. You find the audiences once and run them, and that’s it. If you run automated bidding, then audiences and bidding aren’t that big of a deal either. The same can be said for negative keywords.

So, how can you optimize your Google Shopping campaigns to get more out of them?

Below is a list of optimization tactics:

Weekly

- Bid management

- **Product group structure must be managed for manual bidding.

- Merchant Center review

-

- Product disapprovals

Monthly

- Negative keywords

- Standard optimization

- Excluding forever vs. just now

- Showing the right product for searches

- Moving to a fallback campaign

- Feed improvement

Quarterly

- Product exclusions

-

- Exclude/downgrade products

- Reconsider product variants

- Audience layering

Smart Bidding vs. Manual Bidding

One thing you need to be aware of with Google Shopping optimizations is how much better Smart Bidding works versus regular search campaigns.

This is due to the lack of keywords in Google Shopping.

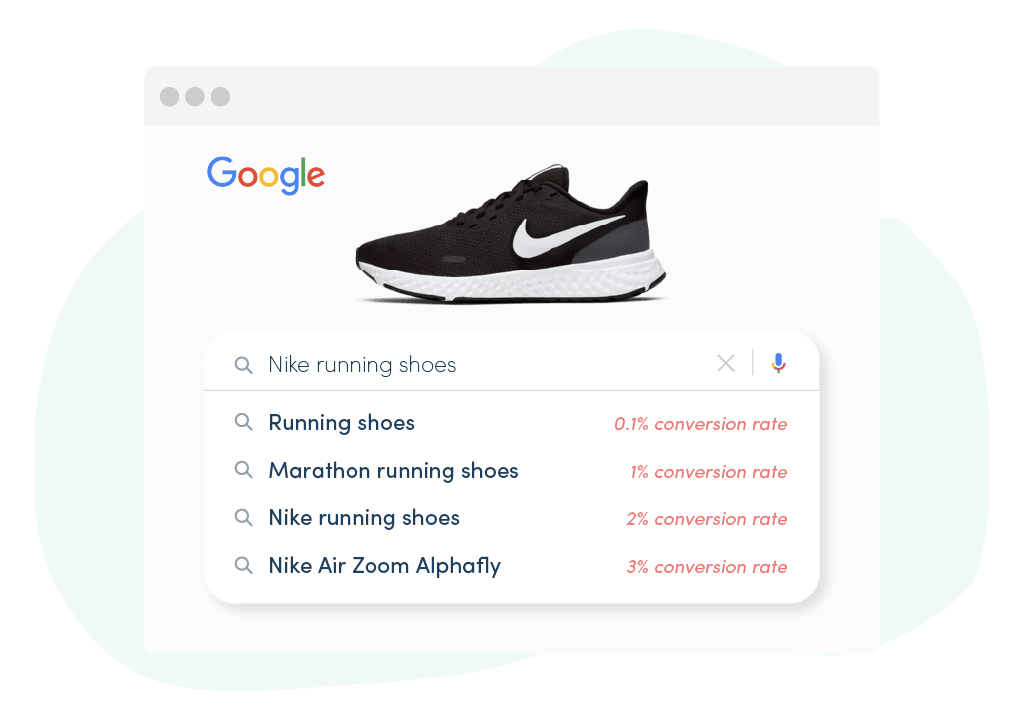

With manual bidding, you are bidding at the product level. Each product will show up for a variety of keywords that all convert at different levels:

With manual bidding, you can only set a bid for a product. This means that, no matter how a search term performs, you will still have made the same bid (article: Campaign structures that enable keyword bidding in Google Shopping).

However, Smart Bidding sets a bid for every auction and can bid differently at the search-term level.

This is why, for Shopping campaigns, Smart Bidding will outperform manual bidding most of the time (if the prerequisites are in place for Smart Bidding to be successful).

This means that if you run manual bidding, then you have to include a campaign structure that supports your running of manual bidding—you can’t just have one campaign and run manual bidding. Therefore, you will be much better off just running Smart Bidding.

Proactive Performance Analysis

To gauge the performance of Google Shopping, you can’t rely on the direct review of the metrics in the Google Ads interface.

It is simply either not nuanced enough or too nuanced.

Any campaign segmentation means splitting up performance across multiple campaigns.

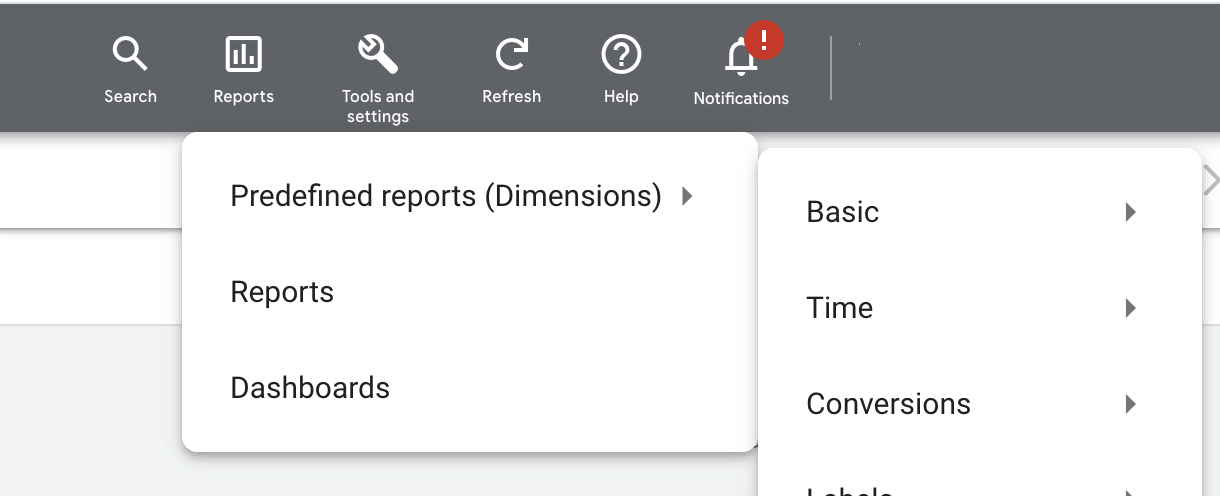

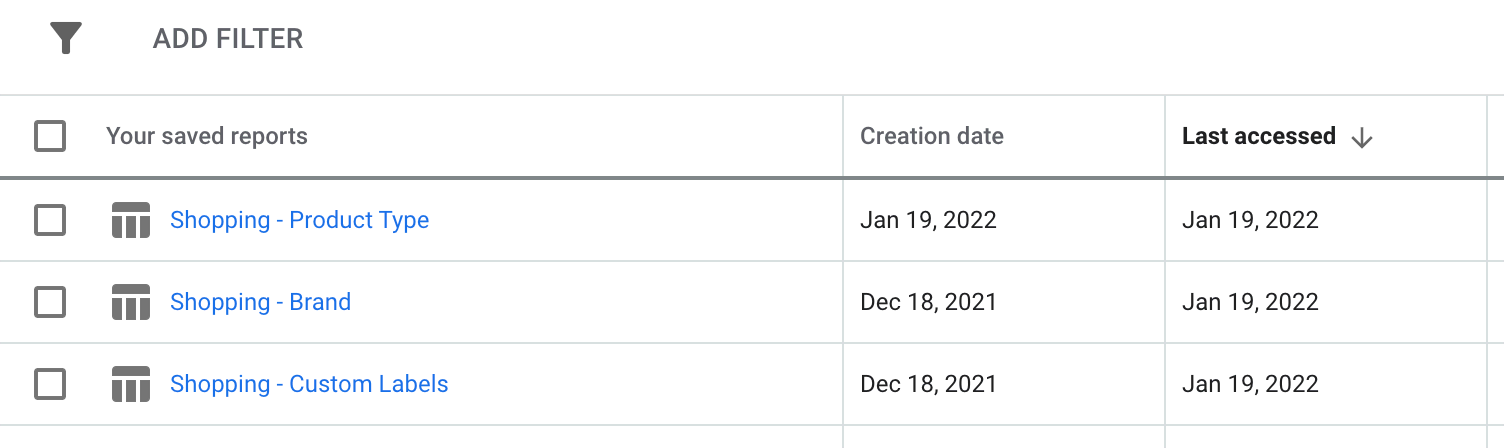

An important tool in your arsenal is the Reports section of Google Ads:

Reports in Google Ads allows you to engage in analysis on multiple levels, including but not limited to the following:

- Brand / Product Type analysis

- Custom labels

These analyses might help answer questions such as the following:

- Are new products being exposed properly?

- Are some brands increasing/decreasing in revenue?

- What products perform best?

The real magic comes when you start layering these data points together.

If you don’t have any custom labels applied to your feed, the value of engaging in such analyses will be diminished. However, if you have questions you can’t answer due to a lack of custom labels, it’s important to remember the old saying:

“The best time to plant a tree was 25 years ago. The next best time is today.”

I will typically have these standard reports ready for any account:

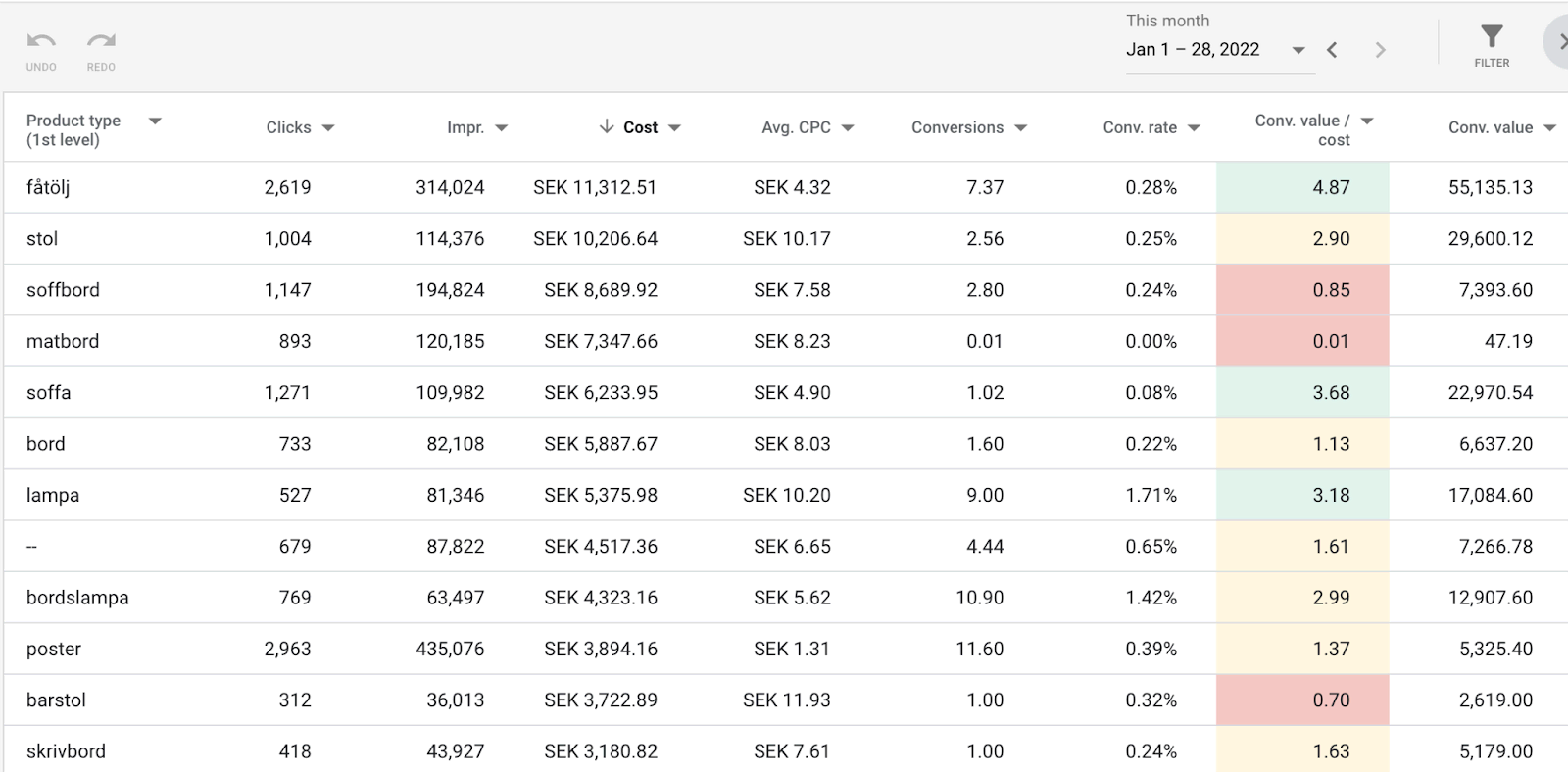

I set them up to include conditional formatting:

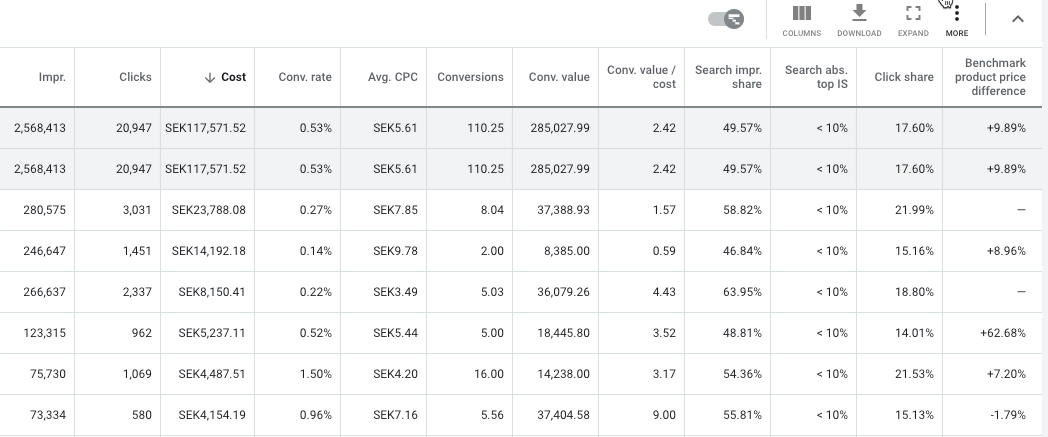

Overall, our Google Shopping campaign in this example is doing 2.5x return on ad spend (ROAS), which is right on the money.

But look at some of the individual categories—they are doing horribly!

These metrics wouldn’t have been revealed as clearly by a direct review of the Shopping campaigns. I loved the Reports section back in 2010 when it was called Dimensions, and I love the Reports section to this day.

Big Picture Optimizations—My Favorite!

After performing the routine optimizations and reviewing the data, it’s time to look at the big picture optimizations.

This is where Google Shopping really shines. While there are several primary ways to set up Search campaigns, Google Shopping optimization is all about changing the campaign structure, building out your data, and working on the big picture items.

For most of our larger advertisers, we would typically make a major change to their entire Google Shopping strategy once a year. Granted, some of our advertisers have run the same structure for 5 years, but that’s because their business strategy hasn’t changed much.

But as you go from 5k to 10k products, you often need to revise your strategy, and that’s where big picture optimizations come into play.

I have split the various ideas for big picture optimizations below:

- Try a new campaign segmentation/structure

- Keyword performance

- Differentiated ROAS strategy

- Price monitoring

- Manual vs. Smart Bidding

- Smart Shopping

Try a New Campaign Segmentation / Structure

One of the key optimizations you can make to a Google Shopping campaign is restructuring the campaign(s).

The idea is to help with Smart Bidding, but before doing so, you need to understand how Smart Bidding works:

- Smart Bidding is effective because it reacts live to changes to historical data in comparison to your manual bid that hasn’t been updated for weeks.

- Furthermore, Smart Bidding includes more signals than you can include.

- Smart Bidding is made up of mathematical formulae that machines run much better than you do (I’ve written extensively about this before).

While this is all good, it’s all reactive; there are no indicators as to the future. If I know that I shouldn’t sell winter parkas in San Diego in February (really, you shouldn’t), Smart Bidding will spend thousands of dollars to come to the exact same conclusion.

Across a big inventory affected by many factors, the cost of devoting parts of the budget to come to conclusions we already know adds to a lot of wasted money over a year (although the more stable your inventory/market is, the more the costs will taper off).

This is where helping Smart Bidding and Google Shopping comes in. The way to do this is by using priority settings to tell Google what products to show first or by making other changes.

Here is a list of main ideas on how to segment and thereby optimize your Google Shopping campaigns:

- Keyword/Query Split

- Bestsellers

- Cheapest

- Variants

- Margins (not preferred)

- On Sale vs Not on Sale

- New vs Old

For more details on this, please see my full guide to Google Shopping campaign structure.

Search Term Performance

Another important aspect is looking at search term performance.

It’s included above but really requires its own segment.

Understanding what search terms are generating the best results (revenue at a profitable ROAS) is important as you try to scale your Google Shopping efforts.

If all your results are coming from a single group of searches (generic, category, branded, product, etc.), then you have a huge upside in finding a way to make the other groups of searches work for you.

Try a Differentiated ROAS Strategy

Many of us love Smart Bidding, but it’s so one-sided.

What about incrementality?

An advertiser might want to get a 400% ROAS from their overall advertising spend, but if they know they are profitable at 300%, and you can get more revenue by moving all mobile traffic to 300% ROAS—well, then that is not possible without splitting up your campaigns.

I’m very aware that Google recommends keeping everything in the same campaign to maximize the data. And that’s good advice if you don’t make any other changes to your campaigns. Furthermore, splitting your campaigns into 5 just to set the same ROAS targets for all of them is pointless.

But splitting your campaigns into 5 major categories to track performance at a granular level and optimize ROAS targets to maximize profits from each category—that’s powerful and trumps any best practices recommended by Google.

We often try to split Shopping campaigns into one of the following segments granted we can set different ROAS targets:

- Private Label products

- Categories

- Keywords

- Audiences

- Devices

Don’t do this simply because I have written about it. Do it because it makes business sense to you.

Customer Journey Consideration

This is another campaign segmentation you should consider if you have a large inventory.

Let’s say you sell products at $50 AOV and $2,000 AOV, which is not unusual for large stores.

Do you think there is a difference between how customers buy a $50 product and a $2,000 product? Yup!

So why do we keep them in the same campaign with the same bidding signals?

As I wrote in our Smart Bidding article, data stability is key to ensuring the effectiveness of Smart Bidding. You will see a lot more fluctuation in the data for expensive products versus lower-priced items.

There is a lot to be said for moving your highest-priced items into a separate campaign where you set bids based on longer timeframes—and even manually if you don’t have enough data to support it.

I once tried running a campaign for higher-priced items on Smart Bidding, and after 6 months, the percentage of revenue from this campaign in the account had gone from 25% to 5%.

By switching to manual bidding, I was able to restore it back to 25% and sustain this number. Do you know how I sustained it? I didn’t decrease bids just because ROAS was bad for a week or longer. I maintained exposure for our core bestsellers no matter what because I knew we would get 10–20 conversions all of a sudden, which would change the ROAS calculations completely.

A similar strategy has worked very well in many cases.

Price Monitoring

If I had a dollar for every time an eCommerce manager had told me,

- We have the same prices as everyone else’s;

- Our margins are as strong as everyone else’s; and

- Our pricing is solid;

Then I would be a millionaire. They would just gasp when they start monitoring their pricing and discover how far off they are on key products.

We can’t get past the fact that price is a major factor in a consumer’s decision to buy a product, especially for branded products where you get the exact same product, whether you buy it on Target.com, Walmart.com, Amazon.com, or BestBuy.com. As such, price matters.

Convenience is a major factor as well, but at anything above a roughly 10% price difference for branded products, you will start seeing a steep drop-off in conversion rates in most markets.

I have written in depth about how to use price monitoring tools for Google Shopping, so I will just summarize the tactics:

- Price comparison is not just about being $1 cheaper than a competitor.

- Set healthy prices that support marketing, increase revenue, and ultimately ensure a good profit.

- Stock, product variant, margin, etc. are all important to consider before setting your pricing structure.

- Even if your products are priced higher than that of your competitors, they can easily sell fine—and in some cases better—than if they were cheaper.

But the biggest thing you need to consider is that, even if you are not going to change your prices, just knowing what they are compared to that of your competitors is a meaningful advantage in managing your Google Shopping efforts.

Manual vs. Smart Bidding?

There are times when it makes sense to move parts of your campaigns onto manual bidding for a certain period. I’m not advocating this in general, but there are times when you should want a bit more control, reset the data, or simply run spend at a specific budget.

There are situations where manual bidding simply outperforms Smart Bidding for a variety of reasons:

- Brand-new campaigns

- Low-volume campaigns

- Moving into a high season

- Campaigns for volatile categories

So, if you find evidence that it might be better to run something at manual bidding, then try it.

Smart Shopping/Performance Max Consideration

Our main Smart Shopping article provides an in-depth look at the advantages and disadvantages of Smart Shopping, and it should be a consideration for everyone at some point.

It’s ignorant not to understand how the campaign format works and how to use it when it works. You might be between agencies, or you might be at a point where you can’t get your other Shopping setups working properly.

Maybe it’s time to set a new baseline, and Smart Shopping could be used for that particular purpose.

Smart Shopping is very simple to run, and too simple in my book for optimal returns, but it should be the benchmark to beat. If you can’t beat the performance from a Smart Shopping campaign, then you should run Smart Shopping; it’s that simple.

What Metrics Matter in Shopping Campaigns?

For regular text ad campaigns, we’ve all grown accustomed to using the same old metrics, such as average position, impression share, max CPC, actual CPC, CTR, or ROAS. You know what to look for when optimizing a bid. It’s ingrained in you.

However, in Google Shopping campaigns, one crucial aspect is gone: average position.

This throws a lot of PPC managers for a loop when they try to optimize bids because you wonder, what should you optimize for now?

- Conversion value/cost

- Conversion value

- Conversion rate

- Impression share

- Absolute top impression share

- Click share

The regular average CPC and other metrics are still used. However, these are my key metrics for Google Shopping.

A metric I also like to include is the benchmark product price difference. This can be useful if you don’t have price monitoring on your products otherwise.

I rarely use the benchmark CPC and CTR metrics. It’s too much of a black box because you don’t know what other industries/products Google is comparing you with. If you exclude all the big, generic keywords (i.e., couch), you’ll most likely have a higher CTR than your competition but also a higher CPC.

Industry-Specific Optimizations for Google Shopping

There are some optimization tactics for some industries that you should review, whether they apply to you or not.

Product Sculpting: Matching Products to Searches

Since first writing this article back in 2018, Google has largely become much better at matching the right products with searches. As such, for most industries, doing any kind of product sculpting has become a thing of the past.

For product-specific searches, I don’t see a need to engage in this form of optimization at all.

For generic keywords, let’s say, “couch,” hundreds of different product variations are likely eligible to be shown.

So, which product(s) do you choose to showcase for this high-volume search?

You can create a segmented campaign approach using campaign priorities, which allows you to

- Show best-selling products “first.”

- Show items currently on sale “first.”

I’ve seen both approaches work very well.

“Less Than 20% of Shoppers Buy the Product They Click On”

This surprising statistic was initially shared by Crealytics. I think you can work on improving this metric for your specific store, but at the same time, it’s a reminder for you not to worry too much about whether the perfect product is shown every time.

Especially for generic keywords, the chances that the consumer buys the exact product they clicked on in the search results are slim to none. Most generic searches happen in the research phase of the buyer’s journey, so expecting them to make a decision early on is very optimistic.

Note: This is the same reason why splitting your Google Shopping campaigns based on margins is important. If shoppers don’t buy the product they click on, then splitting your campaigns up into margins will lull you into a fake sense that something is working.

The better option is using profit tracking.

Negative Keywords: Not as Simple as You Think

When it comes to working with negative keywords, you have to think twice before just excluding away.

Let’s say you sell couches, and yo

u have 10 different brands within the couch category.

If one of those brands shows up most often for the search term “couch” but doesn’t convert, what do you do? Generally, you’d either bid lower or add the search term as a negative keyword.

But it isn’t that simple.

What if the reason for the low conversion rate is because the wrong product or brand is showing up for the “couch” search?

Then, excluding your campaign from showing up for that search term will just limit your campaign’s potential.

Instead, reevaluate the product’s or brand’s performance for those searches and do one of the following:

- Exclude the searches from that brand’s ad group.

- Exclude that brand/product from that category/product type ad group.

This allows the keyword to be shown for other brands/products with better success. This is a whack-a-mole tactic. Sometimes, you’re better off working on the big picture with the campaign segmentation tactic mentioned above.

Product Variant Management

One of the more difficult things to keep in mind is variation management.

The traditional way of thinking about product variants is different sizes or colors of the same product, but depending on exactly what you’re selling, you might have different variants. No matter what the actual attribute is, it’s important to keep this in mind when optimizing.

A typical scenario is when a product group has been selling very well but starts to decline in performance. As it declines, you, or your system, decrease the bid, which may cause your product group to perform even worse.

Let’s say that the reason why the product group stopped selling was because the most popular size/color went out of stock. So, when the popular product comes back in stock, it should start performing better immediately, right?

Well, yes and no.

If you’ve been smart and divided that individual product variation into its own product group (as with product 17022 above), then you will still have the original bid, and everything will be good.

However, if you were bidding on the product group as a whole, then you’ve decreased the bid for this item, and it might not get a lot of impressions/clicks now that it’s back in stock.

Depending on how many products you have, keeping track of this can be impossible.

Custom Labels to the Rescue

You need a system that allows you to monitor when you’re out of popular variants and when to pause all variants. For instance, if you’re selling a men’s running shoe and sizes seven through 10 are sold out, then you should probably pause all the variants of that shoe so that it’s not getting clicks.

Your favorite feed management system should be able to do this:

- Group product variants by the main product (not child product).

- Identify the most popular variants.

- Set a rule that if those x% of those variants are out of stock, then you exclude all variants.

Easy peasy.

How to Deal with Hundreds of Product Variations

Another version of this is how you measure performance across hundreds of variations that all get a handful of clicks each. Google is a massive black box in terms of how both Smart Shopping/Performance Max and Smart Bidding work with this.

Bras are amazing examples of this—there are dozens of colors with dozens upon dozens of size matches.

But in the end, it’s the same product, so performance should be similar.

The problem is playing whack-a-mole with bidding. You, or Smart Bidding, work to improve the chance of conversion.

You need to do two things:

- Always include the value item_group_id. This tells Google that the products are linked, and we’ve seen this strategy work pretty well.

- Group child products using Custom Labels. This is only because you can’t structure product groups based on the item_group_id attribute, so if you are doing manual bidding, you need to use custom labels* for this. It also enables better reporting at the parent product level.

*Custom labels can have a maximum of 1,000 unique values, so make sure your total number of parent products is less than 1,000. Otherwise, you can’t rely on the data.

Revising Your Campaign Segmentation Choice

Let’s say you’ve created a new Google Shopping campaign structure using segments to separate brand and generic searches, but you’re not seeing improved performance.

This happens—and it has happened to me more than once, but you need to give your new setup time to improve. You need to tweak your bids for each campaign, model negative keywords, and generally optimize your Google Shopping campaigns before you can give up on a new campaign structure.

Our rule of thumb is to wait 2–3 months before judging whether a new campaign setup is working or is a waste of resources.

Just be careful that you’re not oversimplifying the results. You might see that your generic and brand campaigns have the same ROAS and think, “What a waste of time.” But, are you using the same bids for the same product groups in each campaign?

If you are, then yes, you are most likely wasting your time.

But if you’re not, then that’s exactly the beauty of segmenting your campaigns. You have successfully set specific bids for how your generic and brand searches perform individually.

Conclusion

Optimizing Google Shopping campaigns doesn’t have to be particularly complex. However, if you don’t have the basic foundation in place to enable you to optimize your searches, it will be increasingly difficult for you to optimize efficiently.

Don’t get stuck with the fact that shopping ad campaigns are different from text ad campaigns. Embrace the wonders of not having to manage keywords or write new ad copies all the time and instead being able to focus on what you can control.

The majority of advertisers are not doing 90% of the things on this list, so if you get started, you’ll easily get ahead of most of your competitors.

6 Comments

This priority setting only makes a difference when there are two or more shopping campaigns that contain the same products.

Yes and no. As I highlight in my Google Shopping campaign structure guide, then that’s a typical approach.

However, if you have similar products that can rank for the same terms, then you can still use the priority settings to give preference to certain products.

Hi! This article is filled with answers to my ample questions. I am starting a new blog and this article will be a bookmark for my future reference. Thanks for sharing this informative article.

Hi Andrew, Thanks for the great article.

Just FYI when I clicked on the link about scaling Google Ads accounts to go to your post at Search Engine Journal I land here: https://www.searchenginejournal.com/underperforming-google-ads/410935/

Thank you for the heads up, it’s fixed now.

I’m glad that you liked the article 🙂

Thank you so much for letting me express my feelings about your post. You write every blog post so well. Keep the hard work going and good luck. Hope to see such a beneficial post ahead too.