Here’s the case for not doing profit-based bidding in Google Ads, despite what everyone says. I see agencies, in-house teams, and freelancers all making the same mistake: they recommend it to everyone, without exception.

On paper, profit-based bidding sounds like a no-brainer. You simply import your actual profit from a transaction—revenue minus COGS, taxes, shipping, etc.—into Google Ads instead of the full revenue. One of my good friends in the industry even runs the best software for it. But I’m tired of seeing agencies preach profit-based bidding as if it’s the end-all, be-all for e-commerce. It’s not.

There are serious drawbacks in certain scenarios that nobody seems to want to talk about. So, let’s cut through the “best practice” BS and get into the nuance. I’m a big fan of the strategy when it’s used correctly, but it’s my job to tell you when it can blow up in your face.

Go Beyond the Article

Why the Video is Better:

- See real examples from actual client accounts

- Get deeper insights that can’t fit in written format

- Learn advanced strategies for complex situations

First, Let’s Acknowledge the Benefits of Profit-Based Bidding

Before I tear it down, let’s be fair. There are three main use cases where profit-based bidding is genuinely powerful. I’ll rank them from least to most beneficial.

1. Discovering Your Ideal Profit Volume. Google Ads bidding has a magical “S-curve” where a lower ROAS target can sometimes generate a much higher profit volume. By tracking profit directly, you can test lower targets and see if you A) make more total profit despite lower efficiency, or B) acquire a lot more customers at a slightly lower, but still acceptable, profit per conversion. Both are good scenarios.

2. Aligning Business Goals with Ad Performance. If your entire business runs on profit-based KPIs, trying to translate that into a revenue-based ROAS target in Google Ads can be a headache. Seeing the actual profit number inside the ad account makes reporting and goal alignment much cleaner for everyone involved.

3. Handling Varying Product Margins. This is the golden goose of profit-based bidding. If you sell socks with an 80% margin and shoes with a 20% margin, you can’t use a single ROAS target. You’ll get no volume on your high-margin socks and lose money on your low-margin shoes. Profit bidding allows Smart Bidding to bid appropriately for each product based on its actual profitability. The bigger your inventory, the more critical this becomes.

Two Myths Busted: When Profit Tracking Makes No Sense

There are also a couple of scenarios where implementing profit bidding is a complete waste of time and can even hurt your account.

Myth 1: It’s useful if you have the same margin on all products. I find it difficult having to say this, but if all your margins are the same, there is zero benefit to profit-based bidding. You’re just adding a layer of complexity for no reason and, as I’ll explain, you’re more likely to hurt your account than help it.

Myth 2: Everyone cares about profit. This might sound a bit edgy, but it’s true. If profit isn’t the core KPI your company runs on, then waving around an increased profit number from Google Ads while other metrics tank will make you look stupid. Your boss is more likely to say something like, “Yes, Tim, you produced more profit, but revenue is down 33% and new customers are down 50%. That’s no good.” (I promise I’ll never do that voice again).

The Single Biggest Drawback: It Can Cripple Smart Bidding

Now for the part nobody wants to discuss. The biggest issue with profit-based bidding is that it makes Smart Bidding less efficient. To understand why, you first need to understand what makes Smart Bidding work well in the first place.

Based on our research over the last few years, Smart Bidding efficiency comes down to three things:

- Lots of data. You already know this one.

- Stability in your conversion rate.

- Stability in your Average Order Value (AOV).

Smart Bidding uses these three factors to predict what your ROAS will be for any given bid. When one of these factors becomes unstable, Smart Bidding has a tough time making accurate predictions, which can send your account into a tailspin.

Profit-based bidding introduces exactly this kind of instability in two specific cases.

Scenario 1: You Run a Lot of Promotions

When you track revenue and run a 20% sale on a $100 product, your AOV drops from $100 to $80. Often, the increase in conversion rate from the sale makes up for the lower AOV, so Smart Bidding can still hit its ROAS target without dramatic changes.

But with profit-based bidding, the math changes drastically. Let’s say you have a 50% margin. Your profit on that $100 product isn’t $100; it’s $50. When you run that same 20% discount, your profit AOV drops from $50 to just $30. That’s a 40% drop in your AOV signal to Google, not 20%.

Suddenly, Smart Bidding can’t hit its targets. During a sale—when you want to be aggressive—it will start decreasing bids. Once the sale ends and the AOV signal shoots back up, it will see performance as “too good” and start jacking up bids again. You end up with a yo-yo effect: high CPCs and low ROAS one week, low CPCs and high ROAS the next.

Scenario 2: Your POAS Target is Too Low

Profit on Ad Spend (POAS) targets become overly sensitive at lower levels. If you’re targeting a 200%+ POAS, you’re typically fine. But anything below 150% gets very difficult to manage.

The reason is a matter of perception. If your performance drops from a 150% POAS to 140%, Smart Bidding sees that as a relatively small 6.7% dip—well within the bounds of normal fluctuation. But for you, the business owner, that’s actually a 20% drop in your net profit. That’s a huge deal.

The issue is that you want to react immediately to a 20% profit drop, but Smart Bidding sees a tiny performance dip and does nothing. This disconnect can seriously hurt your account’s profitability.

How to Mitigate The Issues (Without Ditching Profit Tracking)

So, am I telling you to revert back to revenue tracking? Not necessarily. If you have a large inventory with varying margins, profit-based bidding is still one of the best things you can do. You just have to be smarter about it.

Here are two ways to mitigate the drawbacks.

Solution 1: Use Max CPC Limits to Stabilize Bidding

Max CPC limits in portfolio bid strategies can put guardrails on Smart Bidding and enforce stability. Normally, as a hygiene setting, we’ll set a max bid of around 3x the average CPC. But for accounts with lots of promotions on profit bidding, we get much more aggressive, setting it closer to 1.5x – 2.5x the average CPC.

This ensures Smart Bidding can’t get too aggressive when POAS is good or pull back too hard when it dips. We’ve used this to stabilize CPCs and profit for clients who were seeing massive week-to-week fluctuations, ultimately getting them closer to their year-over-year profit goals while preventing the yo-yo effect.

Solution 2: Change Your Implementation – Track, Don’t Bid

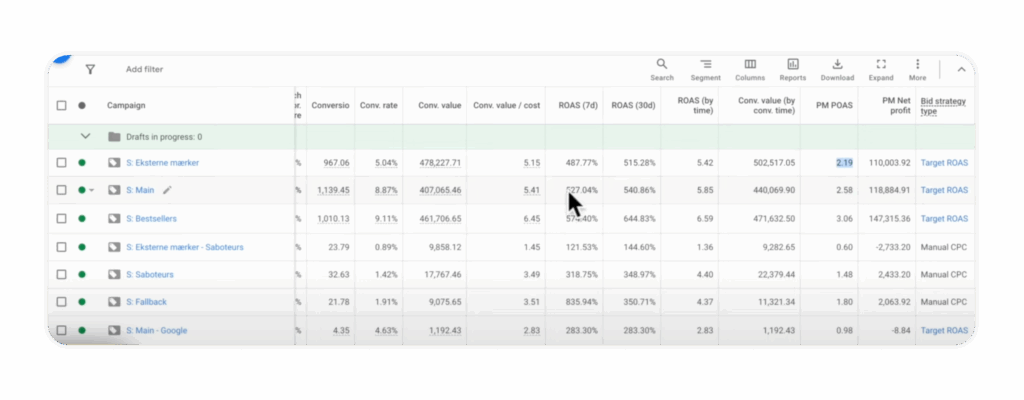

Remember the three reasons to use profit tracking? Only one of them—varying product margins—requires you to actively bid for profit. If your goal is simply to align KPIs or discover your profit S-curve, you can get the insights without sacrificing bidding stability.

The solution is to set up your profit conversion action as secondary in Google Ads. This means Google will track the data, but Smart Bidding will ignore it for optimization. You continue bidding toward your primary revenue-based conversion action.

You can then use custom columns to view your POAS and Net Profit right alongside your ROAS and Revenue. This gives you the best of both worlds: you get the crucial insights into what campaigns and products drive the highest profit, but you also retain the full efficiency and stability of Smart Bidding based on your less-volatile revenue data.

A Powerful Tool, Not a Universal Cure

I hope this gives you a more nuanced look at profit-based bidding. I’m still a massive fan, and I’ll continue to say it’s one of the best optimizations you can make if you have varying product margins.

But it’s not perfect for everyone, especially if you run a lot of promotions. Don’t let the cookie-cutter agencies out there tell you it’s a magic bullet. Like everything in Google Ads, the right answer is always: “it depends.”

[TL;DR]

- Profit-based bidding isn’t a universal solution; it’s often oversold by agencies as a one-size-fits-all “best practice.”

- Its main benefit (the “golden goose”) is for businesses with widely varying product margins. It’s less useful if your margins are uniform.

- The biggest drawback is that it can destabilize Smart Bidding, which relies on stable AOV and conversion rate data. This is especially true if you run frequent promotions.

- Low POAS targets (under 150%) are also risky because small performance dips translate into large actual profit drops that Smart Bidding might ignore.

- To mitigate these issues, you can either use aggressive Max CPC limits to control bid volatility or implement profit tracking as a secondary, observational metric instead of the primary bidding signal.