Summary:

- Comparison Shopping Services (CSSs) are here to stay.

- Google Shopping and CSS Partner Shopping are identical and managed by you.

- You can get a theoretical 20% discount on your cost per click by running Shopping campaigns with a CSS partner Merchant Center.

- Don’t pay more than $50 a month for the service.

- The easiest campaign setup is just to convert your existing Merchant Center into a CSS partner.

- If you’re good at Google Shopping, affiliates shouldn’t be allowed.

- Never ever allow actual CSSs to advertise for your products in Shopping.

- Set it up and move on, so you can do actual Google Ads work as soon as possible.

Introduction

We haven’t written much on this topic because it’s been fairly annoying, and many things changed from one month to the next.

I was also convinced that it wouldn’t stick. I couldn’t, for the life of me, think that our dear Margrethe Vestager would stick to approving of Google’s solution in the Shopping monopoly case.

But here we are, a couple of years later, and I thought it’d be smart to share some of what we’ve learned about running Google Shopping campaigns in Europe on CSS partners.

What is CSS?

CSS stands for Comparison Shopping Service. They came out of a ruling from a case in 2015, which required Google to find a solution that would make its Google Shopping ad spaces available.

The gist of the case was that, because Google put its price comparison engine, Google Shopping, in the search results, without allowing others to do the same, it was monopolizing the search result space.

I won’t discuss the case itself, but IMO it’s a stupid argument. Shopping Ads are just another ad format from text ads. But anyway.

Google was told to allow other Price Comparison Services into the auction, so that’s what we have now:

What Does It Mean?

Basically nothing.

The CSS ads still go to the retailer’s website.

You create another Merchant Center through a CSS partner, to which you upload your usual Google Shopping feed. Everything is the same, but that Merchant Center is registered to the CSS.

In the early days, there were some important distinctions between a regular Merchant Center and CSS Merchant Centers:

- Only Google Merchant Center products were allowed in the Shopping tab. This is no longer the case.

- You needed to create a separate account for your CSS campaigns. This is no longer the case.

- You had to start from scratch with a new Merchant Center. This is no longer the case.

Why Would You Do It?

This is where the meat of the entire CSS discussion happens. Due to the court ruling, you can get a 20% “CPC discount” when you advertise through a CSS.

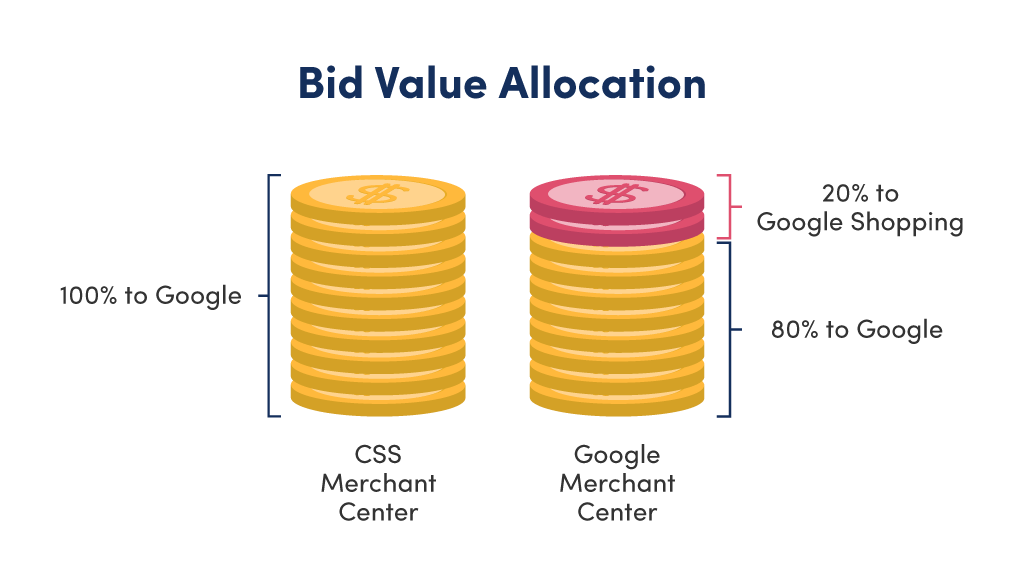

The reason behind this is that Google is forced to make Google Shopping a separate revenue-generating entity.

So, when you get a click from a Google Shopping campaign, 20% of the cost per click goes to the Google Shopping corporate entity, and 80% goes to Google, while, when you get a click from a CSS Shopping campaign, 0% goes to the CSS partner and 80% to Google.

You Don’t Actually Save 20%

So, why isn’t everyone running everything on CSS partners if you save 20%? Well, it’s tricky.

The savings are theoretical. This method provides an advantage in the auction; but it’s not listed anywhere, nor is it a tangible discount. You don’t get it refunded, and it’s very difficult to notice.

ProductHero explains it really well:

The 20% discount on the CPC is not an amount that is refunded or displayed in your Google Ads account. It is a bidding advantage compared to Google CSS.

There is also a distinction between the way many CSS partners describe the discount and the way Google originally described the discount.

Note: I can’t find a single official resource from Google on the discount. As always, I love Reddit, and the link posted there is no longer on Google’s servers: https://comparisonshoppingpartners.withgoogle.com/incentive_program/

So, here, I’m going off the way I’ve read the original articles from Google on this.

Here are the two ways the discount is described:

- CSS Partners mention that the entire $1 bid is used for the discount. That is, a Google Shopping bid of $1 is actually just a bid of $0.8 in the auction.

- My understanding, based on Google’s material, originally was that the discount was on the calculation of ad rank.

Ad rank is a measurement that takes the quality of your ad, combined with your bid, and gives you a value. This is the value that is used to determine what ads show up 1, 2, 3, etc.

There is a big difference between those two understandings.

Here are a couple of examples:

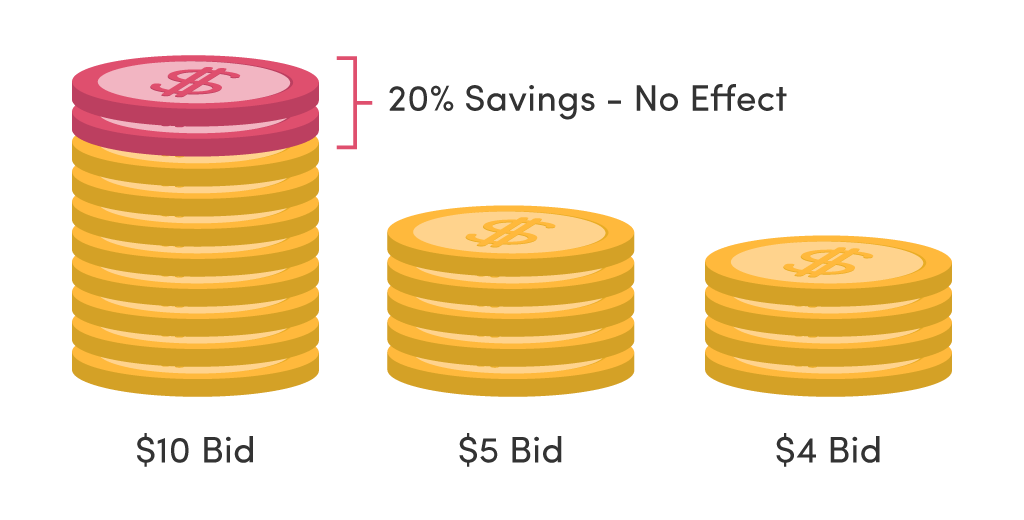

- If your bids are higher than the rest in your market, then you will not reach the 20% savings. Let’s say your bid was $2, and everyone else is bidding $1. Then your CPC will still be $1 due to the way the auctioning system* works.

*Google’s auction system works by determining your cost per click according to what the advertiser right below you in the auction is bidding. So, if your bid is $2 for Position 1, and the advertiser in Position 2 bids $1, your actual cost per click is $1.

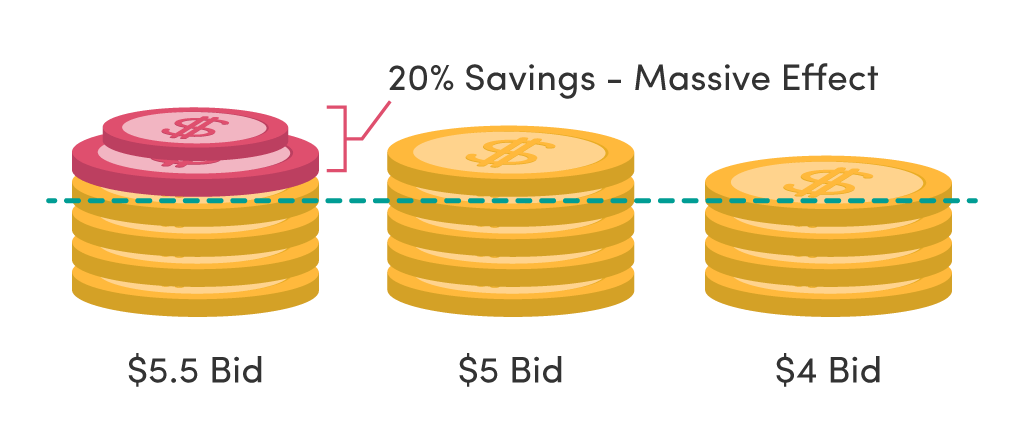

- If you, on the other hand, are right smack in the middle of your competitors when it comes to your bids (i.e., you are among a handful of competitors bidding approximately the same amount), then you can actually save 20%.

This is backed up by a number of our accounts.

The highly competitive markets we’re in—electronics, sports accessories, interior products, fast fashion, etc.—have seen a demonstrable effect from using a CSS partner.

But we also have a number of accounts in which we have never seen an effect.

Let’s take an example:

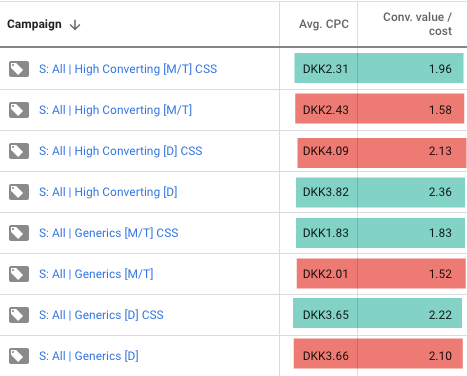

We’re running a hybrid model (more about that later), in which we have the exact same bids in the CSS and Google campaigns, except the bids in the CSS campaign are 20% lower.

In almost all the campaigns, the CSS campaign has a lower CPC and a higher ROAS. Conversion volume is also higher in the CSS campaigns.

Based on this screenshot, I’d assume everyone would jump on CSS immediately.

The thing is that, in this particular market, not everyone has done that, so we are seeing the discounts.

But, if everyone does it, then there isn’t much to save because the savings are only theoretical and only when you’re up against Google Shopping campaigns—not against CSS partner Shopping campaigns.

Don’t Pay % for CSS

There are no advantages to choosing one CSS over another. They all do the same thing.

So don’t pay an obscene amount of money to a CSS partner.

An obscene amount of money is anything above $50–$100/mo.

But we have heard quotes of 2%, 5%, 10%, and even 20% of ad spend being paid to some CSS partners. That’s insane.

If you’re not concerned about who has access to your data, you can also choose one of the many free CSS options out there.

We’ve chosen to move all our CSS accounts to a designated CSS partner outside of the core countries in which we run Google Ads. Call me paranoid, but I feel better having our CSS partner in the Netherlands than having them run by a competitor agency in Scandinavia.

My only recommendation when looking for a CSS partner is to be considerate of the name. Some of them have horrible names, like “Shopping in EU.” (Sorry for calling you out, but we’ve discussed this 🙂 ) or “XYZ Ads,” which, for consumers in some countries, can hurt conversion rates by indicating that the ecommerce store isn’t native to that country.

Choose a provider with a generic name like ProductHero, Comlyn, or something similar.

Convert an Existing or Create a New Merchant Center

To get started with CSS, you need to have a CSS partner Merchant Center. You can either create a brand new one (through the CSS partner) or ask them to convert your existing one.

There are pros and cons with both:

Pros of creating new

- You can run your Google Shopping and CSS Shopping campaigns side-by-side to compare performance.

- You always have your Google Merchant Center to fall back on if something goes wrong with your CSS partner. (It happens.)

Cons of creating new

- All your products start from scratch. A lot of data (like which search results to show your product on) is logged in your product ID, so starting from scratch will, initially, hurt your performance.

The pros and cons for converting your existing Merchant Center are the opposites of the pros and cons listed above.

How to Work with CSS

There are, essentially, three ways to work with CSS partners in Google Shopping:

- CSS only campaigns

- Google only campaigns

- Hybrids: CSS + Google campaigns simultaneously

I’ll list when I think each option is worth it:

CSS only campaigns should be used when you want to get the discount, but you don’t fancy setting up further complexities in your account. This is my preferred option. You get the potential CPC discount, and you’re not creating an overly complex account structure.

Google only campaigns should be used when your budget is so small that you’ll never notice the difference (i.e., below $5,000/mo.).

Hybrid campaigns should be used when you’re concerned about missing out on impressions if you’re using CSS only.

A hybrid campaign structure can be set up in two ways:

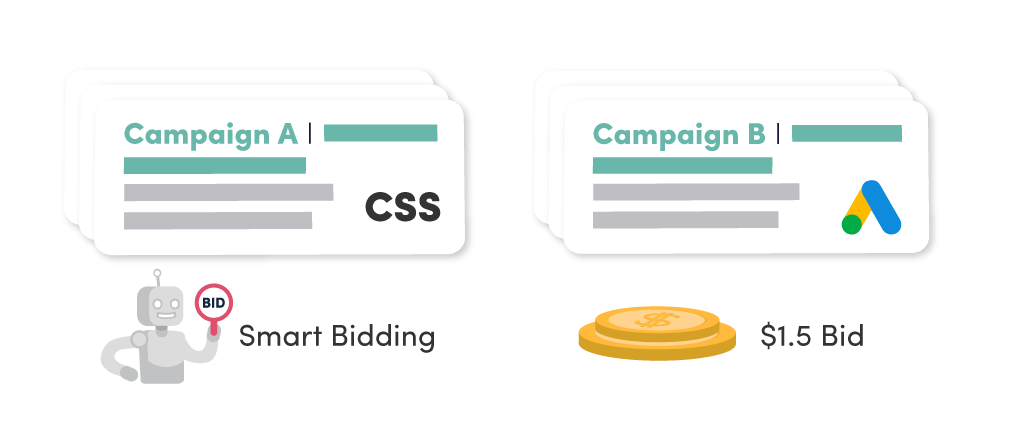

- Duplicate your Google campaigns to your CSS Shopping campaigns, and run them side by side.

- In my opinion, this is not an option if you’re running Smart Bidding. The only way hybrid campaigns work is if you’re maintaining identical bidding in the campaigns.

- Make your CSS Shopping campaigns your main campaigns, and have a fallback Google Shopping campaign with a manual bid that’s 50–75% lower than your bids for your CSS Shopping campaigns.

I’d really like to recommend just going with CSS only campaigns, but we have a handful of large accounts in which the overall click volume drops every time we turn off the Google Shopping campaigns.

There’s nothing tangible about it, but it happens. We’ve tried maybe two to three times with each account, and it happens every time. We’re not 100% sure why, but that uncertainty is enough for neither us nor the client to want to take the gamble.

The counterargument, though, is that we see great results in accounts that run CSS only campaigns.

Google Shopping Affiliates, Huh?

One point that has become a “thing” is the term “Google Shopping affiliates.”

Because you can show multiple listings of the same product from the same retailer for the same search result without being in direct competition with yourself, the concept of Google Shopping affiliates came up.

The idea is that you allow an affiliate to run CSS Shopping campaigns alongside you.

The pitch is that they’ll be able to tap into the search terms, AKA the ad inventory, that you’re not getting into currently.

You can also choose to fully leave Google Shopping to the affiliate and run your most profitable products/“keywords”, etc., yourself.

A good friend of mine is a major proponent of this strategy, while I’m against it.

But we’re much more in agreement than we originally thought.

Here’s Why I’m Against It

Whatever the affiliate can do, we can do it, too, without the added % margin he/she adds.

If the overall results are better from running multiple Shopping campaigns on multiple accounts through multiple CSS partners, then we don’t need affiliates to do that.

As a competent Google Shopping agency—if I may toot our own horn—we can do that as well.

However, that has actually nothing to do with why it’s a good idea for some.

Here’s Why He Recommends it

Finding a good, trustworthy agency isn’t easy. Running Google Shopping in-house often results in untapped potential. So, having an affiliate tap into your untapped potential on a commissioned basis makes sense.

It’s a no-risk way to expand your Google Shopping footprint and get more out of the platform. And, if it’s on a commissioned basis, do you really care whether they’re potentially pushing your own ads aside?

The Biggest Challenge

At the end of the day, if you don’t do much with your Google Shopping campaigns, then letting affiliates run CSS Shopping campaigns can make sense.

The problem is that, if your own performance drops because the affiliate starts getting more exposure, and if your smart automation starts decreasing your bids, your campaigns will eventually run out of steam.

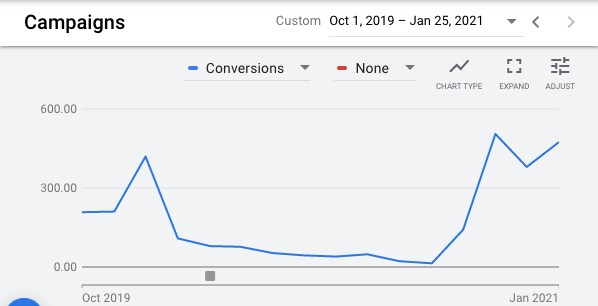

That’s exactly what happened to an advertiser of ours.

They’re in a competitive market, and, when we audited their account, their Google Shopping spend was 10% of their Search spend. Normally, we see a 50/50 allocation. So, we immediately knew something was wrong.

When we reviewed the data back a little over a year, they had also been at much higher Shopping levels:

Can you guess when affiliates were allowed to run on Google Shopping, and when we excluded them again?

Now, that’s not to say this will always happen, but we’ve seen it in two cases now. In both cases, the agency in charge was not paying attention to the affiliates. The Smart Bidding simply started noticing a lower ROAS, and then the negative spiral of lower bids → less data → lower ROAS → lower bids started.

So, no. I’m not a fan, but, in some instances, I see the validity of running CSS Shopping affiliates.

However, for us and other people who are competent within Google Shopping, you can get the same effect as the affiliates will by running it yourself.

The Other Option

The last option for Google Shopping affiliates is having actual Price Comparison Services (i.e., PrisJakt, Kelkoo, Pricerunner, etc.). run Google Shopping on products for which you’re not currently getting exposure. They will set a super low CPC and just tap into the excess ad inventory you’re not getting into.

On paper it makes sense. Pay a very low CPC to a price comparison engine to get more exposure.

No big deal, right?

However, as you dig deeper, it makes no sense.

This is due to the margin on your price per click that you pay to those price comparison engines. For some, you’re contractually obligated to pay a certain price per click. Whatever that price per click is, you can guarantee that the price comparison engine will take a hefty margin.

Instead of using a price comparison engine to gain that extra exposure, you can simply buy that traffic yourself. Start another Google Ads account (or run on the same account), open a second CSS account, and launch your campaigns with low bids. It’s that simple. No need to pay a hefty margin to a price comparison engine for doing that.

Where Do CSS Engines Fit in the Future?

A lot of CSSs came on the market in the initial few months. Some were legit while others were…let’s just call them odd at best.

Most of the serious CSS partners I’ve spoken with are adding complimentary services to their CSS. Many revolve around feed audits, price comparison, or feed optimization.

I think this is super cool thinking.

I recommend choosing to work with people who are investing in their tool, as this will often mean they will stick around.

But it doesn’t matter too much. Choose someone big (so they don’t shut down business one day), someone who doesn’t charge you a %, and go back to actual Google Ads work.

3 thoughts on “CSS: Common Pitfalls, Data, and Ideal Setups”

my experience trying to setup a css was creating a 2nd merchant center account that kept getting disapproved which caused my main account to go down as well, took about a month for me to finally give up and delete it for good, zero help from google support, im guessing no incentive to fix this issue as they don’t want you paying 20% less to them, by far one of the most stressful times i’ve had running my marketing

I also contacted the lawyer involved in the eu anti competitive case against them and said I wasn’t the first person to bring this up

Tough!

But Google can’t help with CSS Merchant Centers at all. It’s completely out of their control.

It’s the CSS partner’s fault if your CSS stops working.

How do free CSS engines monetise their service?