Summary

- My opinion: Performance Max is a paradox. The advertisers who would get the most out of Performance Max are less likely to use it, and vice versa.

- Performance Max replaces Smart Shopping, but it is much more than another type of Shopping Campaign. It’s not a direct replacement, but rather a brand-new version 2.0.

- Performance Max can be shown across Text, Display, and Video Ads.

- Performance Max will take over Dynamic Remarketing, Dynamic Search Ads, Shopping Campaigns, and potentially Text Ad campaigns using phrase/broad match keywords.

- Increasing budgets for Performance Max should be done even more carefully than with Smart Shopping to avoid wasting budget on Display Ads.

- Performance Max can and probably will take over the throne for 70% of in-house advertisers who use Smart Shopping today.

- Performance Max will rarely be used in SavvyRevenue.

Introduction

These are our carefully gathered notes from internal experiments and talking with people in the industry. We did not get to test Performance Max in the real-world context until February of this year, as we did not see fit to do so in the busy Q4. Therefore, much of this article is based only on a few months of our own testing.

Many articles have been written about the basics of Performance Max, so I thought we should start with my personal opinion on it.

My Opinion on Performance Max

I generally think that Performance Max has been mislabeled by many (including Google) because it is seen as replacing Smart Shopping. However, it is not a direct replacement for Smart Shopping, but rather an expansion of the Smart Shopping concept.

Before I go into my opinion on Performance Max, I’d like to explain a bit of the history of how we got to where we are today.

When Smart Shopping was introduced, consultants (myself included) hated the black box, and I still don’t think that hiding data from advertisers is the way to go. There are many scenarios in which proactive input from advertisers themselves can dramatically improve performance.

However, you can’t argue with the improved performance that most advertisers experienced when moving from a Standard Shopping setup (with manual bidding) to a Smart Shopping setup.

Smart Shopping was a better way to run Google Shopping campaigns because it forced advertisers to use Smart Bidding. Simply put, most advertisers (and agencies) ran an overly simplified Google Shopping setup that underperformed.

That’s why more complex tactics, such as query split (where you get some of the control back on keyword bidding for Shopping), were initially so effective. Back in 2017–2019, we would double or even triple revenue/ROAS just using a query-split campaign structure.

Since then, Smart Bidding has become much more effective. It can bid on the Search Term level, which means it has an advantage over manual bidding for Google Shopping.

This takes us up to the launch of Performance Max—the “replacement” for Smart Shopping.

Performance Max is more than just Google Shopping, and that’s the issue.

For an advertiser, when switching from Smart Shopping to Performance Max, if you follow the best practice from Google, you’ll spend money not only on Shopping Ads, but also on Text Ads, Display Ads, Gmail Ads and Video Ads.

What if you don’t want to spend money on Display Ads? Or YouTube Ads?

Anyone who has worked any bit with Display or YouTube Ads knows that spending “a little bit” on generic Display/YouTube efforts is like throwing money out the window.

And that’s what Performance Max is. It promises to spend a little bit, or a lot, of money on the entire Ad Inventory from Google. But is that really what anyone wants?

Advertisers at Savvy with healthy Display or YouTube programs will never take their setup and drop it into the hands of Performance Max. They have spent resources developing creative assets that fit into the right audience at the right time.

Advertisers without the assets to make Display/YouTube effective should not be spending their budget on Display/YouTube using bad assets.

So, for me, taking full advantage of Performance Max is a paradox. It promises to better show your ads across the entire inventory at Google. Which sounds awesome until you realize that you are still limited by the assets you are creating.

Then, if you spend the time/money/resources creating awesome assets, why just throw them into a Performance Max campaign? Why not run them with intent? With a strategy? With the knowledge you have?

That is my opinion on Performance Max for SavvyRevenue.

But for in-house teams and other non-specialized agencies, the world might not be as black and white.

So, let’s dig into Performance Max campaigns.

What’s New with Performance Max?

If you are new to Performance Max campaigns, I recommend watching this video from Google:

The main new areas are:

Ad Inventory Expansion: Google shows Shopping Ads, Text Ads, Video Ads, and Display Ads across their entire inventory. This is similar to what Smart Shopping promised/was supposed to do initially.

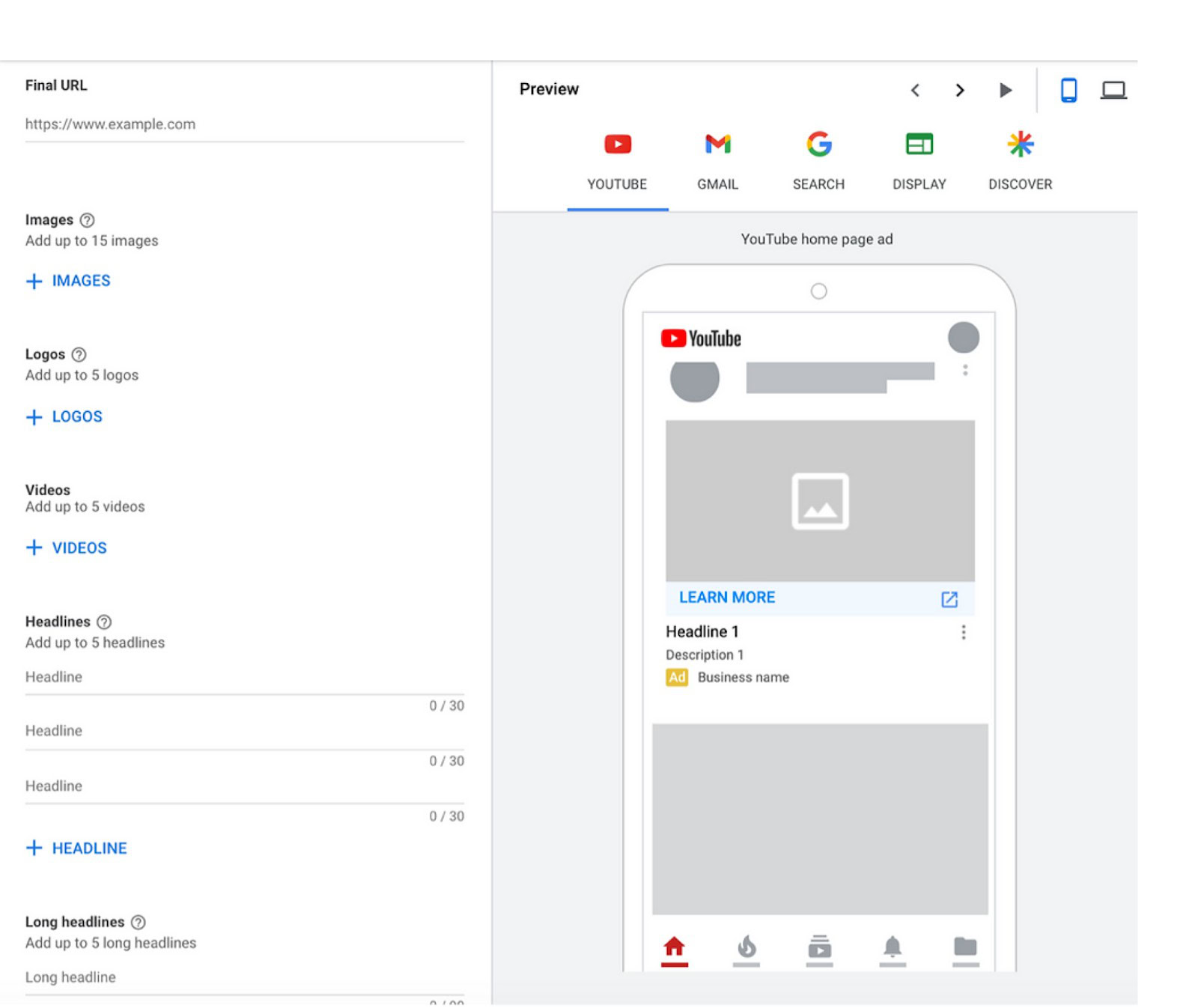

Asset Groups, which consist of:

- Assets: ad copy, images/banners, and videos

- Listing group: products to target (aka product groups)

- Audience signals: a mix of audiences you add

Embedded Dynamic Search Ads: Performance Max campaigns have the ability to function as your Dynamic Search Ads campaign.

Audience Signals: Through this new concept, you can add audiences that will help steer Performance Max to connect with your audience. Basically it’s just a new audiences tab.

Access to Search Terms: There is a performance insights view where you can see the aggregated performance across main Search Term themes.

Pros of Performance Max

- Performance is higher out of the box compared to Standard Shopping.

- Shows up on other Ad Inventory (Text Ads, Display, YouTube Ads) than just Shopping.

- Saves time and resources.

Cons of Performance Max

- Shows up on other Ad Inventory (Text, Display, YouTube Ads) than just Shopping.

- No insights into how much spending goes toward different audiences (i.e., remarketing, existing customers)—a big deal for large brands (IMO).

- Little insight into the split between brand vs. non-brand searches (again, big issue for large brands).

- You can’t differentiate between mobile vs. desktop ROAS targets (except for Value Rules).

- No “nudging” based on your insights. You have to wait for the machine to learn.

- It’ll try products/ads it shouldn’t.

- Increasing budgets might focus on unprofitable Ad Inventory for you.

- Overrides all other Shopping efforts (at the time of this publication).

There were a lot of cons. But the three pros are substantial enough to override many of the cons if you don’t care about them.

Even with those cons, there are still three key scenarios where Performance Max could be the campaign type for you. Let’s dig in.

When Should You Use Performance Max?

1) You lack resources/competencies:

- Not enough time to execute a granular setup.

- Missing necessary know-how in-house.

- Agencies keep promising the world.

2) Established eCommerce stores

- You are not focused on Hyper Optimization.

- Google Shopping is not a main channel.

- More data = better performance from algorithms.

3) No “plan”

- No activities in YouTube Ads or Display Ads.

- Search is not built out.

- Your set-up runs on full automation anyway.

The opposite cases then become the pros for when you should not use Performance Max.

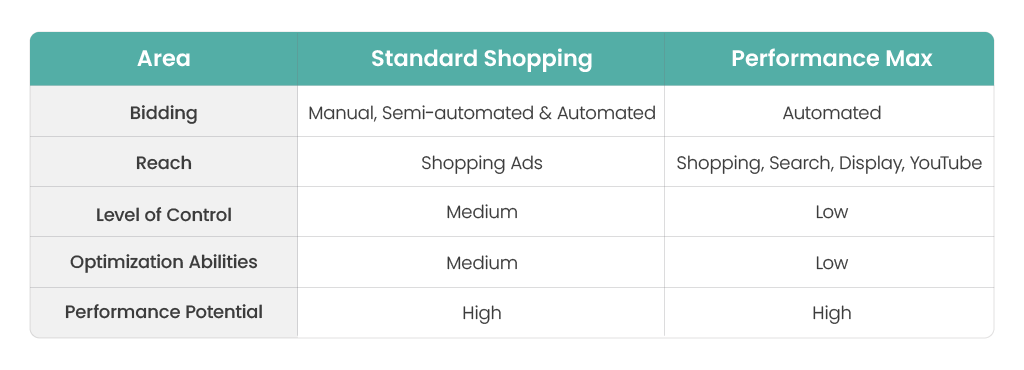

How Is Performance Max Different from Standard Shopping?

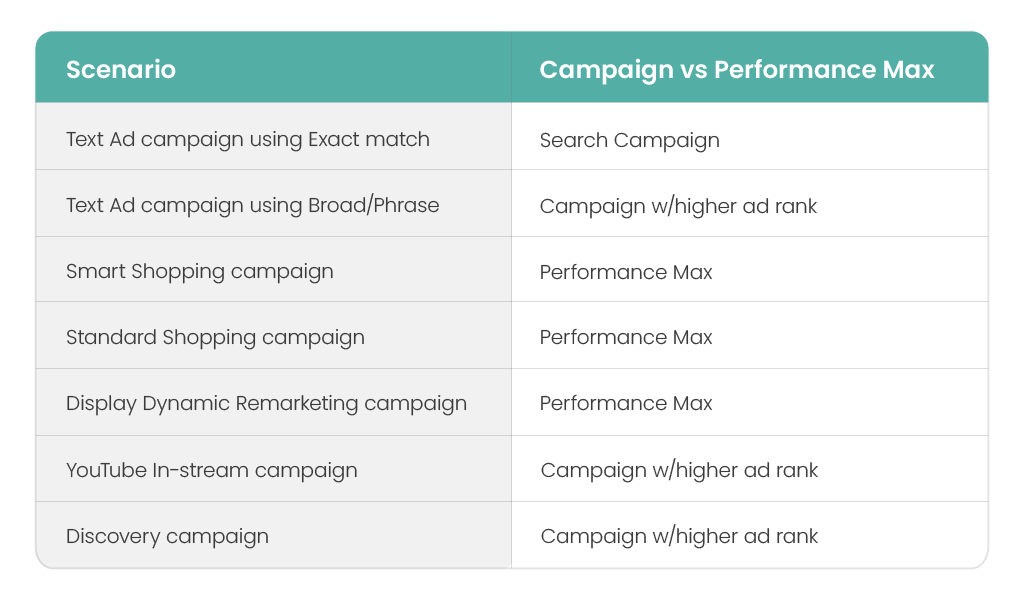

What Impact Will Performance Max Have on Other Campaigns?

This chart is from my friend Dennis, who runs Store-Growers.com and who got it from Alex Van de Pol.

Ad Inventory Issues

My biggest challenge with Performance Max is that you don’t have full control over what your budget will go to.

As I mentioned, Performance Max is not a type of Google Shopping campaign. It’s something brand new. But because it replaces Smart Shopping, everyone is expecting it to be the same.

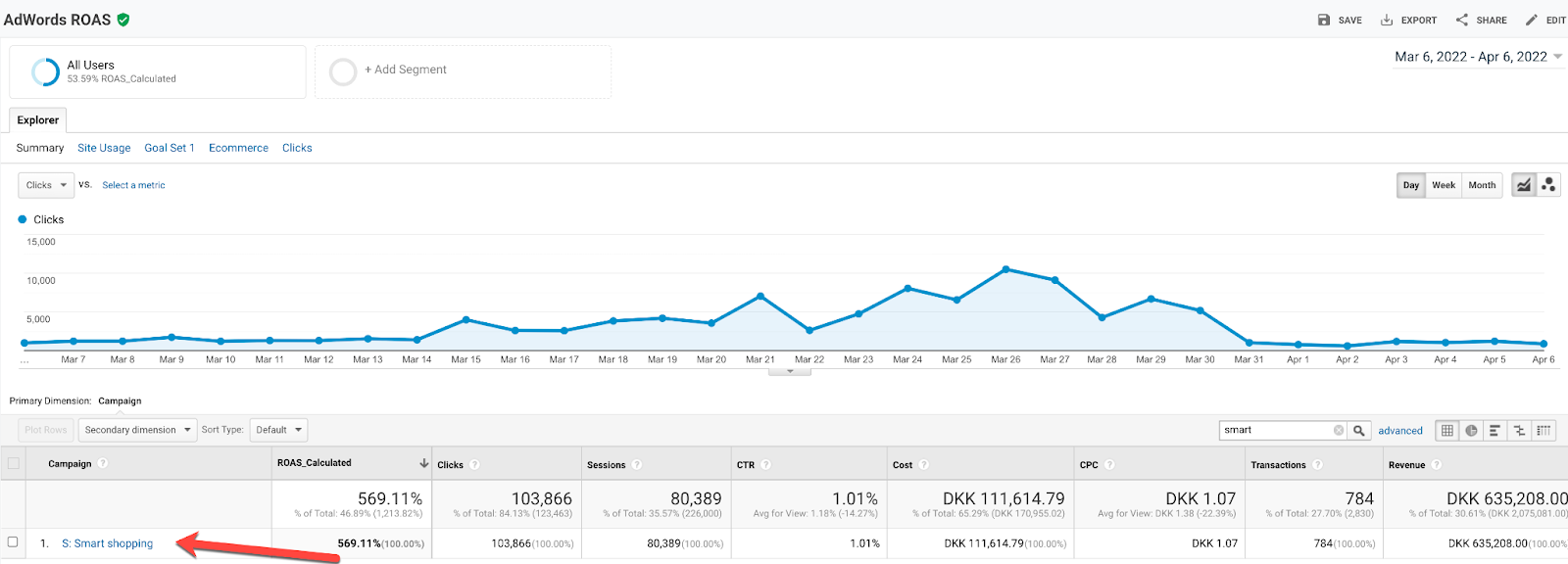

We have already seen that increasing budgets too much in Smart Shopping results in the campaign expanding into the Display network:

The same will happen for Performance Max—just even more than you experience with Smart Shopping.

Increasing your budget is something you have to be more careful about when using Performance Max, as it opens the door to other Ad Inventory.

Let’s review an example:

You might be seeing a 500% ROAS for your Performance Max campaign at $1,000/day in ad spend.

To get all possible Shopping Ads traffic while maintaining a 500% ROAS, you set a 500% ROAS target and increase your budget to $3,000/day.

The 500% ROAS target “ensures” you hit the 500% ROAS, but the budget increase tells Performance Max that you have an unlimited budget.

What you want is to spend as much as possible on Shopping Ads.

However, Performance Max might see this budget increase and decide on the following split:

- $800 for Shopping Ads

- $200 for Text Ads

- $100 for Display Ads

To make up for the lower ROAS on Text and Display Ads, Performance Max needs a higher ROAS from Shopping Ads.

This is a theoretical example, but nothing we haven’t already seen happen in Smart Shopping. So, it’s not a far-fetched idea that this would also happen in Performance Max.

Dynamic Search Ads with No Insights into Search Terms?

Yeah, that’s a horrible idea. But that’s what you get with Performance Max.

Have you seen a Dynamic Search Ads campaign that didn’t require some fine-tuning? That didn’t cannibalize brand terms? That didn’t run ads for your blog?

I haven’t, and it’s the reason why I don’t like to see Dynamic Search Ads being embedded in Performance Max.

Again, I would like to reiterate that I, Andrew of SavvyRevenue, do not like it for general purposes. But, as I listed above, if you never review your Dynamic Search Ads or run a “hyper-optimized” Google Ads account, it really doesn’t matter.

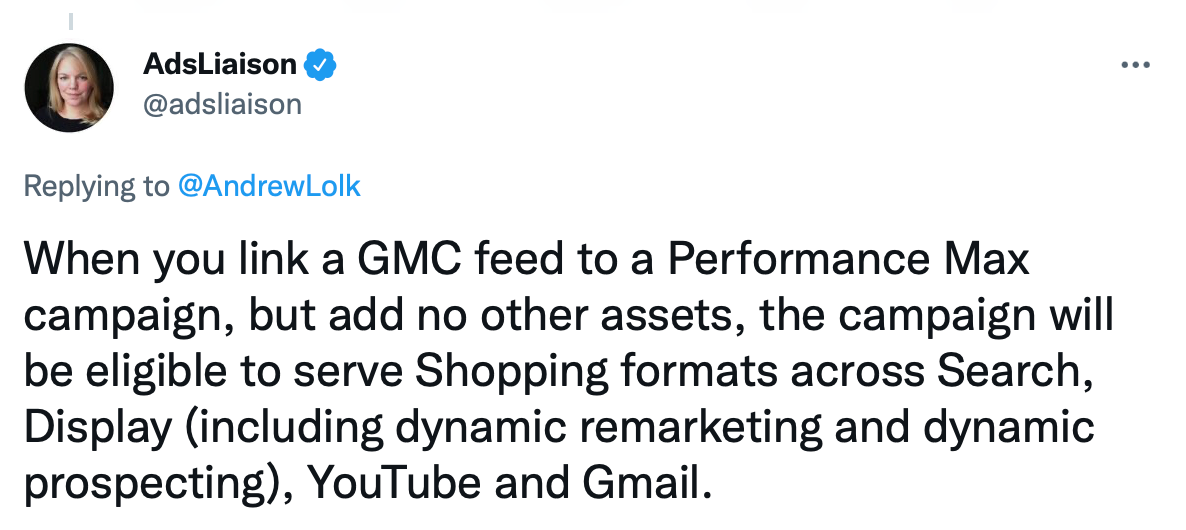

Can Performance Max Function “Like Smart Shopping”?

Technically, if you create a Performance Max campaign without adding any assets to it (no URLs, no headlines, no images, no videos), then it should focus on the Shopping Ads format across the entire inventory:

- Shopping Ads

- Dynamic Display

- YouTube Ads

- Gmail Ads

But you would get out of actively showing regular YouTube video ads or Text Ads.

I’m ambivalent about this.

On the one hand, I think it would be a smart place to start your transition from Smart Shopping. It’s the best way to ensure you don’t waste your budget immediately after transitioning to Performance Max.

On the other hand, I feel that it defeats the purpose. Any day, that loophole can be closed or not function as intended.

If you want to run only with Shopping Ads, you should just spend the time learning how to set up Standard Shopping campaigns with Smart Bidding.

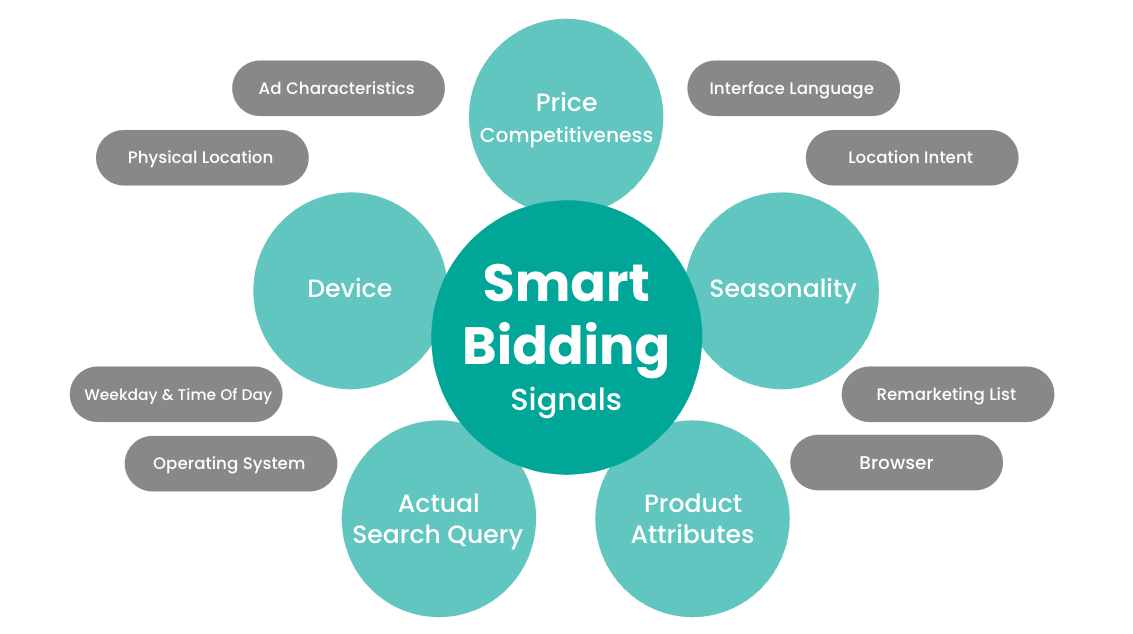

Smart Bidding has become effective, and the list of bidding signals specific to Google Shopping is quite impressive:

My “Tinfoil Hat” Theory

Like many others in the PPC space, I think that advertisers switching to the black box of Smart Shopping was the catalyst for Google jumping into a campaign type like Performance Max.

I ran a large agency with 150 employees and 1-2000 clients. We did the math once: What if every single client paid us $49/mo. for a Remarketing Display campaign.

The math was pretty great:

1500 clients at $49/mo. would result in $73,500 added revenue every month—$882,000 a year in pure profit. We never acted on it, but the proposal was discussed.

Now, I am not one of those people who think that Google is evil in everything they do.

But I would be surprised if there wasn’t a business proposal like the one above for Performance Max campaigns. With millions of advertisers, an additional $100-$1,000/mo. would still add a great deal to Google’s revenue.

Should You Switch from Smart Shopping to Performance Max?

As an agency, we are not jumping on the bandwagon. The reason is simply that we can’t defend to our clients not having insights into where their spending is going.

That’s the dealbreaker for us.

But should you?

That’s a much harder question, and my answer will probably be one you didn’t expect:

Yes.

Many in-house teams, and even agencies, I’ve spoken to over the years have become highly dependent on Smart Shopping. It’s often 50-80% of their revenue from Google Ads.

Switching back to Standard Shopping (albeit with Smart Bidding) will require for most that they spend more time working with Shopping than they have in the past. There are more elements that can go wrong. It’s not as self-optimizing as Smart Shopping was. There are more buttons you can press that will mess up the performance if you don’t know what you are doing.

Even though I don’t like the Ad Inventory issues with Performance Max, or the overlap with other existing campaigns—at the end of the day, there is one thing that is different between hiring an agency and running Shopping in-house:

An agency is paid to be the expert. In-house is not.

Not being able to have all the answers is OK with in-house staff, and having Performance Max spend a bit of the budget on Display or YouTube Ads is OK. It’s all part of the game.

As an agency specializing in PPC for eCommerce, we just can’t defend it.

2 thoughts on “Performance Max: An in-depth look at the Ins and Outs”

I totally get your tinfoil hat theory.

In addition to you list of cons I see it as a huge risk to run Performance Max (and Smart shopping alone), if your conversion tracking for any reason stops working or doesn’t work properly.

In my case I’ve experienced a shop changing checkout financing solution provider, where the new solution redirected to the shop front page after checkout instead of the receipt page (where the conversion tracking track orders). This led to a lot fewer conversions (and value) tracked which made smart bidding lower bids which then resulted in fewer clicks and conversions. And with smart shopping you can’t simply change to manual bids.

But Google have been clever. If they had launched Performance Max instead of Smart Shopping at the time, a lot fewer had felt compelled to use Performance Max.

What would your approach be if you gained a new client which only was running smart shopping with no additional standard shopping setup?

How would you transition to a standard shopping setup without a decrease in performance when not having historical search term data?

Great example, Morten.

The moving off Smart Shopping is a scenario we meet often.

First, I would like to state that moving to Standard Shopping instead of Performance Max / Smart Shopping has to bring higher performance. Otherwise it’s not worth it. So that’s the benchmark.

In terms of how then it comes down to what significant factor we can use for a campaign split using priorities.

Custom product scores?

On sale vs full price?

Priced competitively vs more expensive than the market?

Margins? (I’m not a fan)

Bestsellers?

Seasonality?

And many others.

If we can find a factor/data point that will give us an edge using a Standard Shopping setup then we will move to Smart Shopping. If we can’t find a solid strategy / reason to switch from Smart Shopping then we will not make the switch.