What you’ll learn

- Your price competitiveness is a bigger factor in your conversion rate, ROAS and profit level than most other factors in your Google Ads account

- Price monitoring is not just about being $1 cheaper than the competitor

- Set healthy prices that support marketing, increase revenue and ultimately ensure a good profit

- Stock, product variant, margin, etc. are all important to consider before setting your pricing structure

- Even if your products are priced higher than your competitors, they can easily sell fine – and in some cases better – than if they are cheaper

- How to use your price monitoring in Google Ads

Introduction

“We will never want to incorporate price monitoring in our work with Google Ads.” That’s something I hear a lot from eCommerce stores we work with.

But, then, they also say, “Well, if we can increase our sales significantly by lowering our prices by 5–10%, we’re happy to do that.”

Most of the people I speak with want to use price monitoring and understand (to some degree) the importance of competing on such an important factor as price.

I think eCommerce stores feel they must be ready to lower prices every single time competitors lower theirs.

But it doesn’t have to be like that.

The Big Picture

What Price Mornitoring is and How It Works

Price monitoring, as referenced in this article, is the act of comparing product prices in your store with the same, or very similar, products in other stores.

There are different price monitoring tools out there that can easily help you compare your prices with your competitors. Frigginyeah.com, price2spy.com, pricemanager.com and wiser.com just to mention a few.

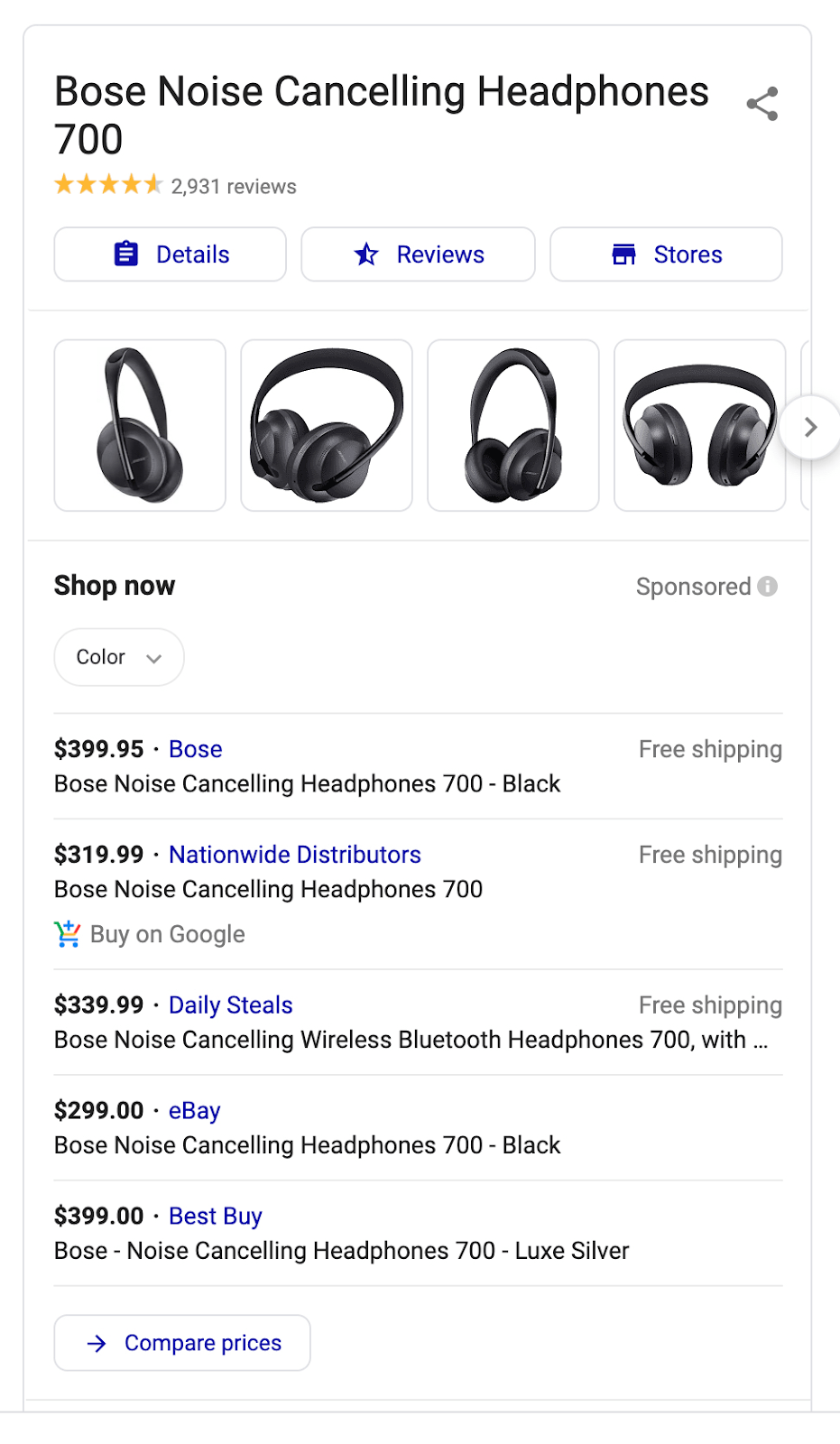

It could, for example, be comparing a pair of Bose 700 headphones.

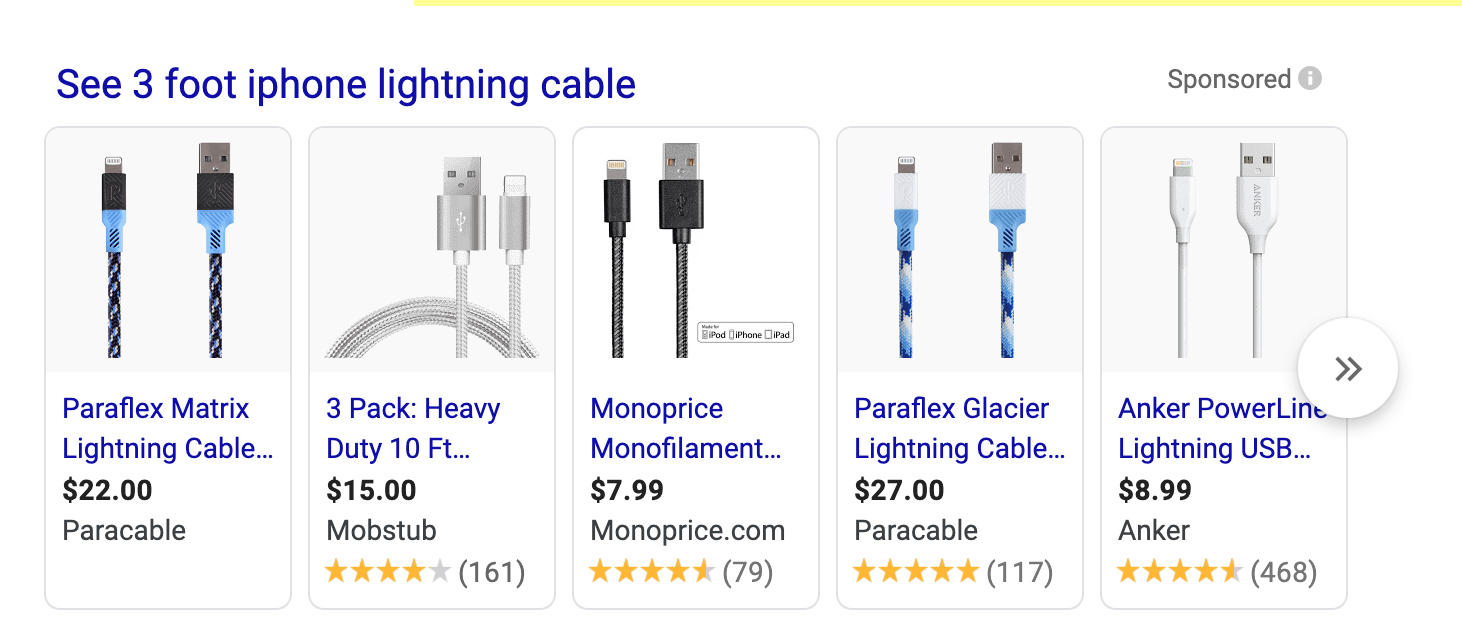

Or, it could be comparing similar three-foot lightning cables.

The first example with headphones is fairly simple, but the comparison in the second example, with generic cables, is much harder.

When we discuss price monitoring, we are referencing products that are easily compared across stores, which will often be branded products. It’s still possible to use price monitoring even if you sell generic or DTC products; it’s just harder to know exactly what products you are supposed to be comparing prices with.

Pricing’s Effect on Conversion Rates

Pricing is one of the biggest factors when it comes to whether your store makes the sale. In the example below, where would you buy the Bose 700s?

Nationwide Distributors is selling them for $80 cheaper than Bose and Best Buy.

It’s the same product. It’s the same guarantee. You’re just buying them $80 cheaper.

Now, eBay is a bit trickier. I—and many consumers—don’t have much trust in eBay, so I’m not even considering the price listed from there.

I’m not familiar with Nationwide Distributors, and Bose is known for being good at enforcing its recommended prices across its retail partners; so I’m actually surprised to see this difference.

But, as a consumer, I’m probably going to buy the headphones from Nationwide Distributors.

Price is a Point of Friction

The more your price differs from that of your competitors, the more likely it is that consumers will buy from your competitors, even if they have worse websites, fewer product pictures, and offer a much smaller selection than you do.

If there is a 5% difference in price, you will most likely get away with it. But, the closer the price difference is to 10% or 20%, consumers really begin to rethink where to buy a product.

Google’s Price Competitiveness in Your Merchant Center

The easiest way to understand what your price levels are is by Googling the product. However, that’s fairly time-consuming if you have more than a couple of products.

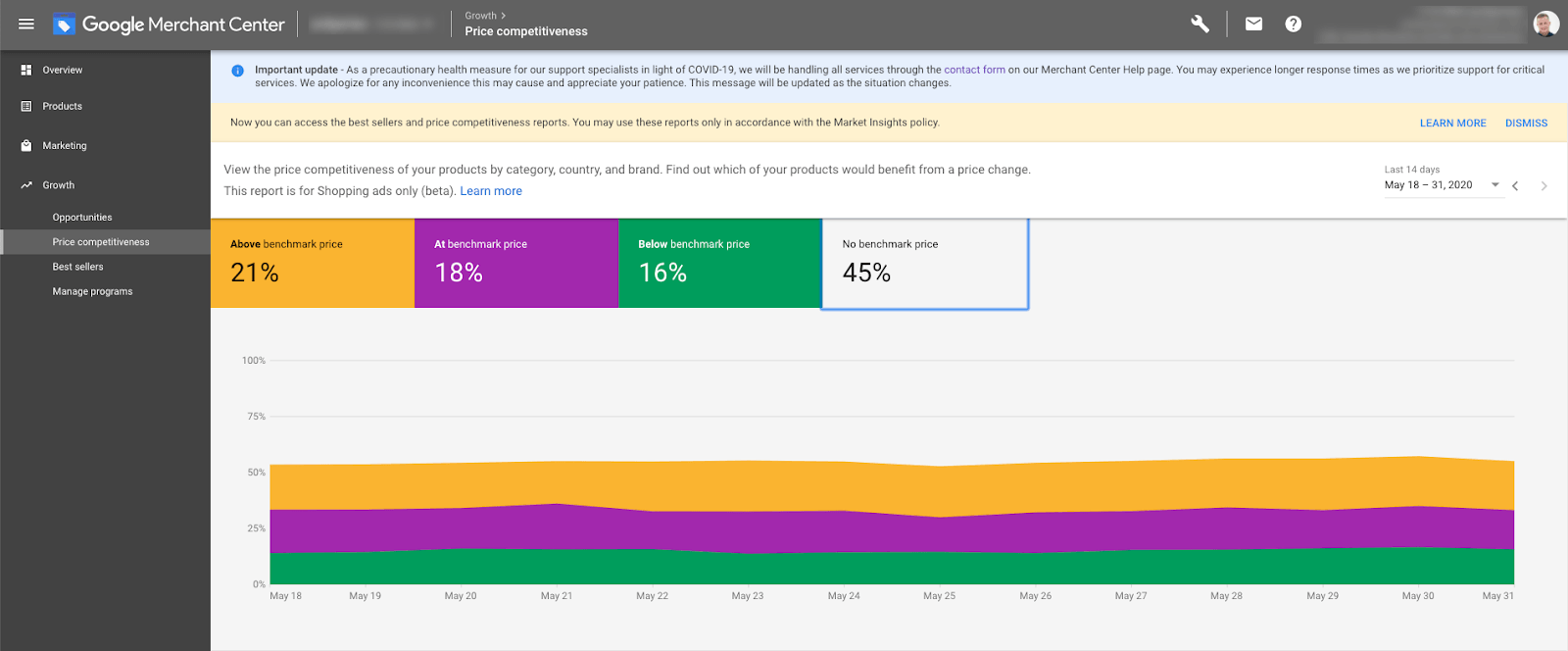

If you’re spending money with Google Shopping, you can get a great overview directly from your Merchant Center.

As the team at producthero.com explained to me the other day, the price competitiveness you see is click-weighted. It means that you will only see price competitiveness for products that are receiving clicks in Google Shopping.

This is obvious in hindsight, but, when I first saw the report, I didn’t understand why 45% wouldn’t have a price benchmark.

Use the Price Competitiveness Report to Gain Insights

The advantage of using the price competitiveness report is that you don’t have to set anything up to gain insights. It’s right there in your Merchant Center.

The report will not replace full-on price monitoring software, but it can be the first step for you to understand how your products are priced.

However, there are a couple of things you should be aware of before you jump in.

- You can’t see what products you’re being compared to.

- Your price benchmark can be based on products you don’t compare with but that are in the same auction as your products. So, this is not a bulletproof system if you’re selling generic products for which Google can’t use Global Trade Item Numbers (GTINs) for comparison.

- This is not a 100% live price monitoring report. Pricing information isn’t available live when you need it (as of this writing), so it’s not useful for live bidding changes. Still, it is better than nothing.

How to Use Price Monitoring Data with Google Ads

The main idea behind using price monitoring data is being one step ahead.

As we’ve shown, your price can be a definitive factor in whether you make the sale. Translating this into Google Ads terms, your price is a definitive factor in increasing or decreasing your conversion rate and ROAS.

All bid management today is about being reactive.

Your ROAS has been high for the last seven days? Bid higher.

Your ROAS has been low for the last seven days? Bid lower.

It’s all reactive.

But, with price monitoring data, we can implement a factor that allows us to be proactive.

If our products were priced equally with competitors last week, and if we had a 500% ROAS, but this week our products are 20% more expensive than those of our competitors, we’ll most likely have a lower ROAS.

This means we can decrease our bids before we spend money learning this.

It sounds complicated, but we just implement another factor into our bidding in Google Shopping:

- If your price is more than 20% higher than that of your competitors, you decrease your bids.

- If your price is >5% lower than that of your competitors, you increase your bids.

Now, there are a few other factors to include (which I’ll touch on in our playbook section), but, in essence, you can get a step ahead by using the thinking above.

The Playbook

Nuances of Price Monitoring

Price monitoring doesn’t have to be this endless race to the bottom to be cheaper than everybody else.

Some of the questions you have to ask to set the right pricing strategy are:

- What competitors do you want to compete with?

- What margin do you want?

- Perhaps a different margin per category/brand.

- Do you want to be cheaper than, to be more expensive than, or to match your competitors’ prices?

- What if competitors do not have the product in stock?

I’ll dig into these below.

What competitors do you want to compete with?

Not all competitors are created equally. Some competitors buy small quantities of products and resell them at ridiculously low prices.

There might always be a couple of these in the ad auctions at the same time as you, but that doesn’t mean you should match their pricing.

If they run out of product within a day or week, maybe you should just ignore them and stick to matching prices from your immediate competitors.

What margin do you want?

In most price monitoring tools, you can ask the tool to match prices until you reach a certain margin level—meaning that, if you need to have a 30% margin on Nike, then you can tell the tool to lower your price until it reaches the 30% margin.

At that point, the tool will not lower your price further—even if competitors’ prices are much cheaper than yours.

This can ensure that you aren’t selling products you aren’t making any money on.

Do you want to be cheaper than, to be more expensive than, or to match your competitors’ prices?

Most eCommerce stores just think of being cheaper, but, in some cases, it may make sense to be more expensive, as this allows you to advertise more.

It’s odd, and I’ll expand upon it below.

What if competitors do not have the product in stock?

Competitors who do not have your particular product in stock should ideally be excluded from any price monitoring you’re doing.

Still, it’s not that simple. Many eCommerce stores will list products as “out of stock,” but will ship any orders immediately when they get the product back in stock.

Technically, the product is out of stock, but, practically, it’s not. Consumers will still wait five, ten, even 15 days for the product they want if they can get it at a much lower price.

How to Optimize Google Ads Using Price Monitoring Data

There are to main points related to using price monitoring data in Google Ads.

- Increase and decrease your bids based on your price monitoring data.

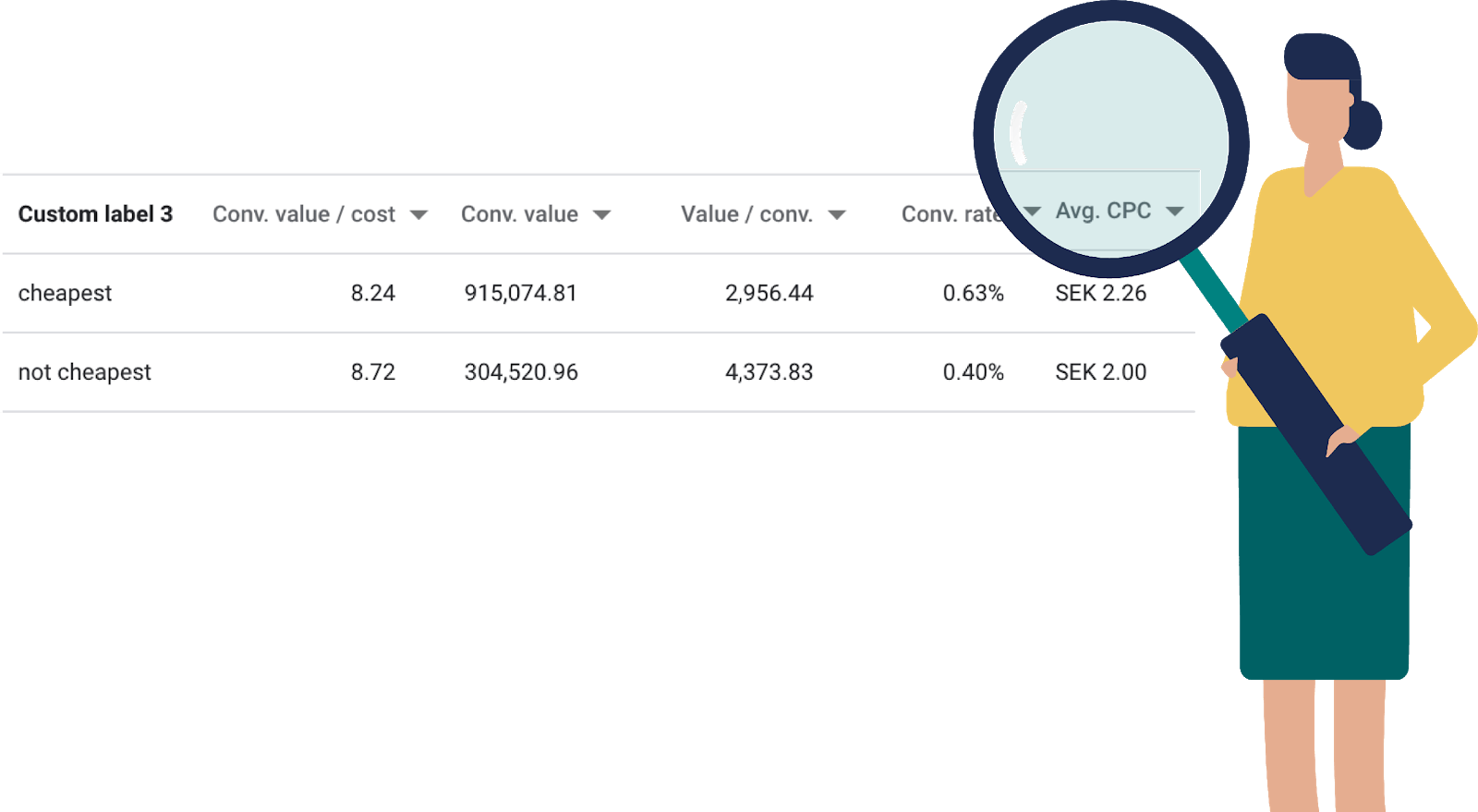

- Understand when your conversion rate, or ROAS, increases/decreases in Google Ads.

The second point deserves extra attention. Too many times, we just bid up and down in PPC by being reactive. We review performance for the last seven, 14, or 28 days and decide how to manage bids moving forward.

However, if you can start understanding your price point’s impact on conversion rates, you might be able to turn this on its head and start bidding proactively.

What You Need to Know Before Optimizing Google Ads

Though it is commonly believed that you shouldn’t be profitable when your products are more expensive than those of your competitors, this is not always the case.

Still, many people jump the gun and exclude the products with which they aren’t competitive.

A better course of action is to try setting lower bids for your products that are more expensive. Try to find the highest possible bid at which you’re still profitable.

In addition to this, some categories are very price-sensitive, while others aren’t at all. Don’t try to predict it. Just get the data; see what the data says, and then start being proactive.

You can only predict performance if you have data proving that your predictions are true. Otherwise, you’re just guessing.

Understanding your profit levels is key to any successful pricing strategy. Decreasing prices to be competitive while keeping the same ROAS levels is a road to destruction. You will be less profitable, and we’ve even seen cases where it’s been outright detrimental to the business.

See our article on ROAS vs. profit tracking for more insights on the topic.

Implementation of Price Monitoring Data in Your Bid Management

This is really where the meat of this post is for a PPC specialist. The rest has been more focused on the business side, but now we are finally getting to the actual implementation in Google Ads.

I recommend two different ways of working with your price monitoring data in Google Ads.

- Use campaign priorities to prioritize cheaper products.

- Set bids based on whether your prices are cheaper, neutral, or more expensive.

In both cases, it starts by adding your price monitoring data to a custom label.

Adding Price Monitoring Data to Custom Labels

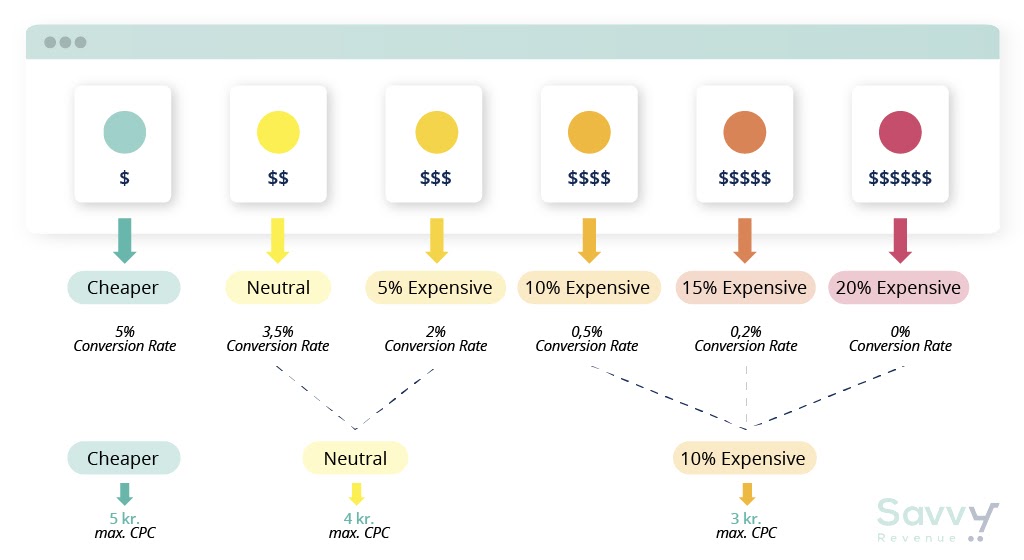

Using your favorite price monitoring software, you should produce three different custom labels:

- Cheaper.

- Neutral.

- More expensive.

Exactly how you bucket these products will depend on your market and how price-sensitive your customers are.

In the example below, we’ve grouped products that are 0–5% more expensive together in the neutral category.

Products that are >10% more expensive have been put in the more expensive category.

This enables us to:

- Use campaign priorities to prioritize cheaper products.

- Set bids based on whether your prices are cheaper, neutral, or more expensive.

I will explain these in further detail below.

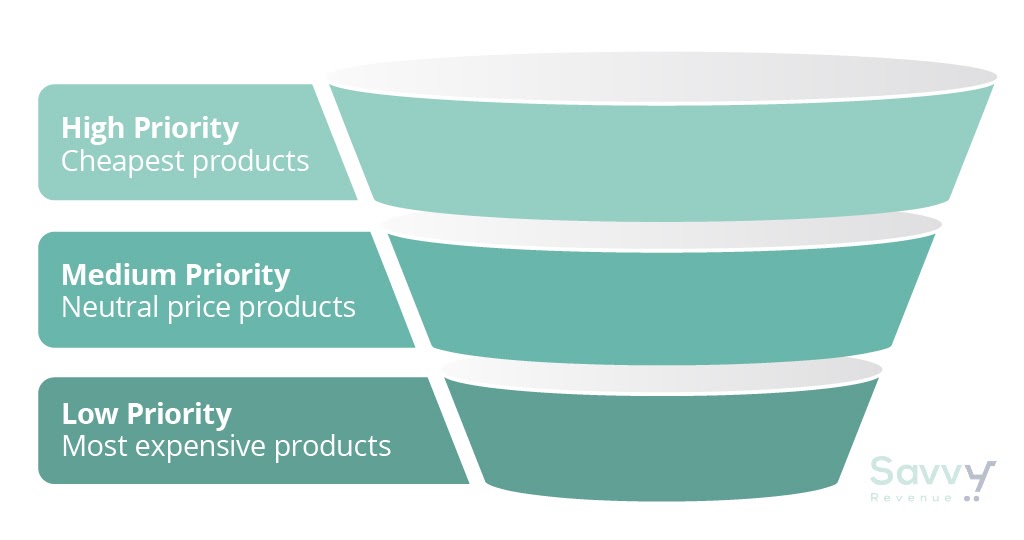

1) Use campaign priorities to prioritize cheaper products.

Maximizing your performance with Google Shopping is based on using the factors with the highest impacts on your conversion rate.

For some markets, this is related to the search term (i.e., the keyword-split campaign structure), while, for others, it can be:

- Price level.

- On sale or not.

- In stock or not.

With this knowledge, we use campaign priorities in Google Shopping:

This way, we can tell Google that it should prioritize showing cheaper products first, but, if we don’t have a cheaper product that matches a search, then it should move on to neutral products.

Again, notice how we’re not excluding anything. We are setting careful bids on the different levels that correspond to the profit levels of each price level.

If you’re already using your priorities, or if you’re not ready for that kind of complexity (since it’s not always beneficial to split your data into multiple campaigns), then you might prefer just using bids to manage pricing levels.

2) Set bids based on price level.

By building your product groups with the custom labels you’re using for the price level data, you will be able to set bids based on exact pricing levels.

Notice that this tactic only works for manual bidding. Breaking out product groups has no effect on how Smart Bidding sets your bids.

Use Price Levels for Dynamic Remarketing

I feel that dynamic remarketing is fundamentally broken. We give Google all our products and say they’re all equal just because they were visited once on our website?

Nothing could be further from the truth.

What we’ve done, with great success, is limit what products appear via dynamic remarketing, both in Facebook Ads and the Google Display network.

In this case, it could be limiting what products are advertised based on their pricing levels:

If people have visited a product you have priced at 20% more expensive than your competitors, chances are those visitors didn’t buy from you because the price wasn’t right.

It could be other things, and they just might not have decided yet. But chances are it’s a pricing issue.

So, what good does it do to continue pushing that product to them in dynamic remarketing? No good at all.

Conclusion

Price is a major factor determining whether customers choose to buy from you.

Getting that data and using it in your Google Shopping campaigns can be a major competitive edge for you.

However, this is not an easy fix. It’s not something you just wake up today and start doing—especially if your role is “just” PPC specialist, as it requires cost data, integration with tools, etc.

Still, it is doable, and the fact that it’s not an easy fix should make you want it more. The harder something is, the less likely it is that your competitors are doing the same thing.

2 thoughts on “How Price Monitoring Affects Your Ad Performance, and How to Get In Front of It”

Nice article.

Is there anything we can do with pricing competitivity at Max Performance campaigns?

Can Google AI use a custom field with that data as a signal? Maybe separate products in different campaigns according to price competitivity?

Would that help Google Smart bidding understand the products?

And I get same questions about delivery time in Max Performance campaigns.

Yes and no.

You can group the campaigns based on their price level compared to competitors (cheaper, same price, more expensive) and set different targets for these campaigns.

IMO this is where we’d use Standard Shopping with priorities instead of Performance Max. I’ve written about how we use price competitive insights in Shopping here 🙂