Today, I want to explain a concept that sneaks past most PPC managers.

But first, let me start with a story;

In 2017, I took over an account in a high AOV industry. The previous agency had decreased the spend in the account from $90,000/month to $40,000 over a four-month period.

This was back in the manual bidding days, so reviewing what they had done was easy. Over the months, they had slowly decreased their bids week by week.

They had what appeared to be a strong bidding process every Monday, but when I reviewed the week-by-week performance, I noticed that they were decreasing the bids.

I reviewed the previous week’s performance, and I didn’t get it. The weekly ROAS was better than the target.

I then had an aha moment.

When I reviewed performance for the last week, I could see that the ROAS was indeed below the target, so they had decreased again.

This concept is called conversion lag.

Conversion Lag is the difference between when people click on an ad and when they actually buy something.

Back in 2017, we used it to calculate how much we should increase/decrease our bids.

Today, we use it to calculate how much we can depend on the ROAS number we see in an account and understand why Smart Bidding does what it does.

How to Calculate Conversion Lag

The way to calculate this is to log the ROAS for a specific day and then go in every day to log the updated ROAS.

It should look something like this if we’re tracking the conversion lag for Sunday:

- Reviewing on Monday: 300% ROAS

- Reviewing on Tuesday: 400% ROAS

- Reviewing on Tuesday: 450% ROAS

- Reviewing on Wednesday: 480% ROAS

- Reviewing on Thursday: 500% ROAS

- Reviewing on Friday: 510% ROAS

- Reviewing on Saturday: 520% ROAS

- Reviewing on Sunday: 525% ROAS

The longer your conversion lag is, the longer this cycle will take and the longer it will stretch out before you can define your 100%.

I recommend doing this exercise daily for at least a couple of weeks. It only takes 5 minutes per day.

The idea is to get some rough estimates of how long it takes for your ROAS to be at 95% of how it will conclude.

The Bake Rate for Daily ROAS Calculations

A bake rate is defined as the multiplier used to estimate the final performance of a metric, such as ROAS, based on partial data, allowing you to predict how much that metric will “bake” or increase as more data is collected over time.

If we assume that we can see the final ROAS after seven days, the example above will have the following bake rates:

- Monday: 1.75x

- Tuesday: 1.31x

- Wednesday: 1.16x

- Thursday: 1.09

- Friday: 1.05x

- Saturday: 1.01x

- Sunday: 1.00x

You can use these bake rates to learn whether “yesterday’s ROAS” was good or bad by multiplying it by the bake rate for Monday: 1.75x.

So, if the ROAS from yesterday was 200%, you can expect it to get up to 350% after a week.

This way, we can more accurately determine how good performances have been in the past few days instead of just telling our boss, “Well, we have to wait a few days.”

The Higher the Price, the Bigger the Conversion Lag

There are two reasons for this:

- The higher the conversion value, the bigger the impact it will have on your ROAS when the conversion actually hits.

- The higher the price, the longer it will take for consumers to be in the consideration phase.

On the other hand, buying an iPhone cable takes a few minutes for most.

The Challenge with Smart Bidding and Conversion Lag

Smart Bidding will look at your performance over the last seven days, and if your account normally gets 40% additional conversions (a bake rate of 1.4x), it will wait while decreasing the bids until the full period is over.

That’s normally great, and it’s a feature of the system that has become really effective. It drives a lot of your performance.

However, it can also hurt you.

What if those extra conversions never come?

Then, Smart Bidding will not realize your current ROAS is lower than the target you’ve set, and it will take three to seven days for it to start decreasing your bids.

But it might take even longer if your conversion lag extends to two to three weeks (i.e., >$1,000 products).

This is when being out of control gets frustrating.

This situation usually happens when you’ve run a sale, and your performance drops back to normal, but Smart Bidding is not decreasing your bids because it’s waiting on the conversion lag.

How to Counter Smart Bidding Conversion Lag Challenges

There are two ways to counter it:

- Apply a negative seasonal bid adjustment

- Increase your ROAS target

Both come with pros and cons.

1) Apply a negative seasonal bid adjustment

This is the fastest way to fix it. Apply a -25% seasonal bid adjustment, and your bids will drop by 25%:

But when your adjustment runs out, you’re back to square one because you’ve essentially told Smart Bidding it was just a temporary drop-in conversion rate.

So you need to phase them out:

- For three days = -25%

- For the following two days = -15%

- For the following two days = -5%

Then, you can expect it to adjust back to normal. Keep in mind this phase might be different for your account.

2) Increase your ROAS target

Increasing your ROAS target will signal to Smart Bidding that it’s time to decrease your bids.

However, if Smart Bidding is still waiting for 40% of your conversions to come in, then increasing your ROAS target by 20% will not be sufficient.

This is why when you think you’re making big adjustments to your ROAS targets, nothing happens.

Smart Bidding is still waiting.

The solution is to add the target by 40% and then gradually move the ROAS back down 10% every one to two days until you’re back at your optimal target.

Smart Bidding’s Version of Conversion Lag: Future Opportunity

Google has its own version of this.

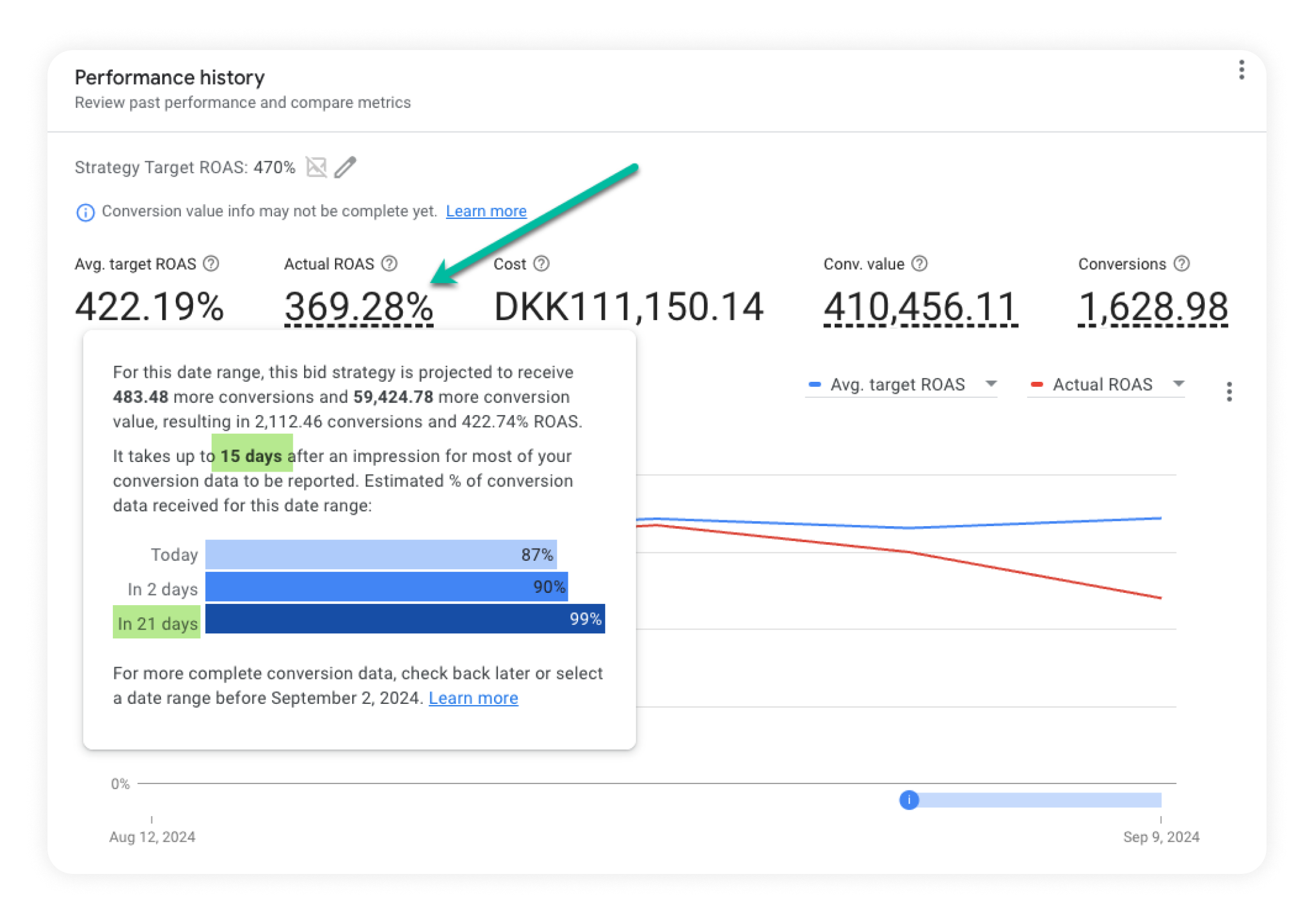

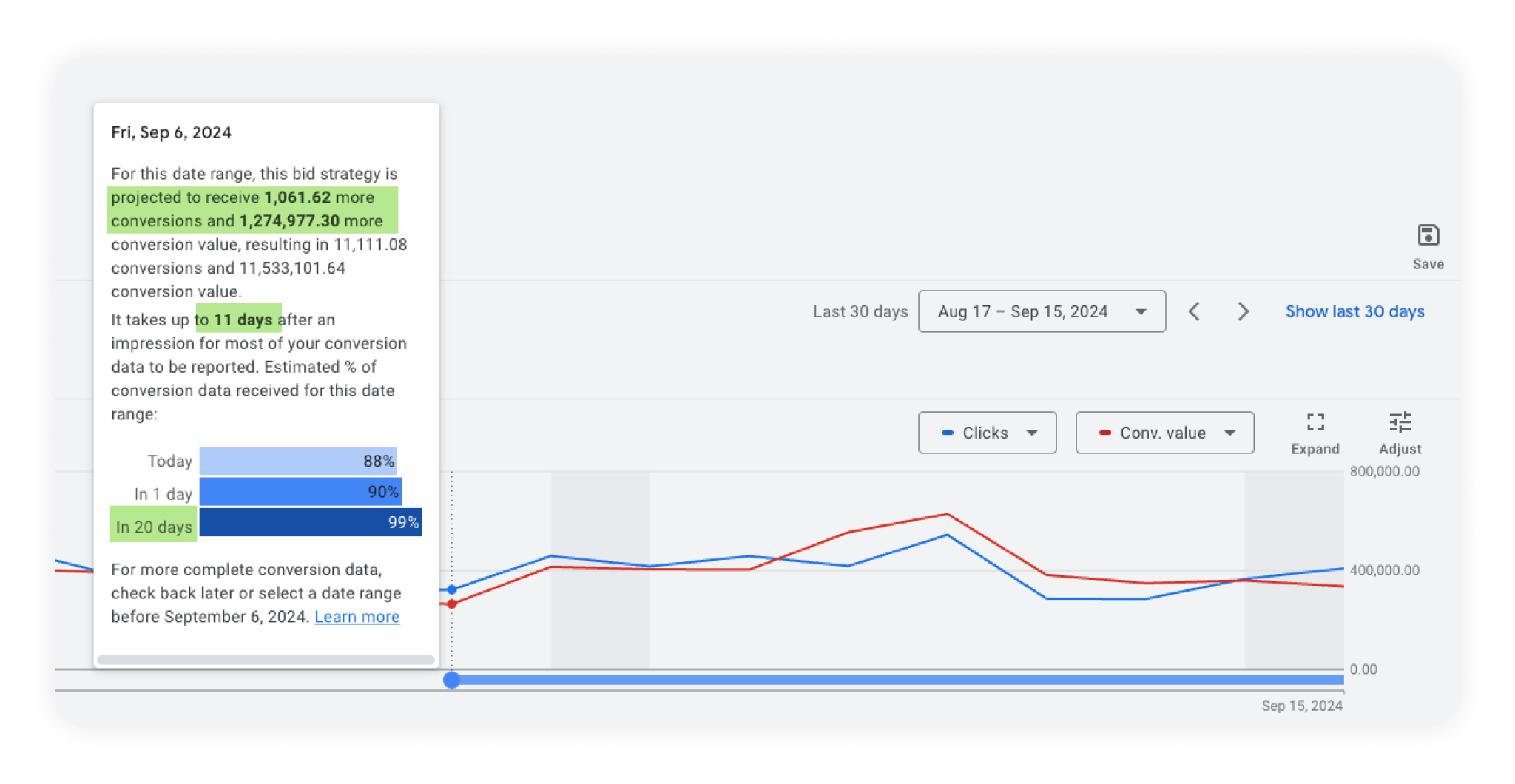

If you open a portfolio strategy and review performance for the last 14 days, it’ll tell you how many more conversions it’s expecting to come in.

You can also see on the campaign view, but only in certain situations:

It’s generally correct, but I’ve also seen it vary from the bake rates that I’ve calculated myself.

I like to use it to understand how Smart Bidding is behaving.

Google’s official documentation of this feature can be found here.

Conversion Lag, Conversion Windows, and Their Impact on Smart Bidding

The conversion window defines how long after a click happens Google should still count the conversion. It’s a conversion tracking setting.

For most eCommerce stores, the best practice is 30 days, but its impact on Smart Bidding is interesting.

We recently advised a large B2B client to move to a 30-day conversion window. They had moved to a seven-day conversion window when we took over, and the account was tanking.

We explained how much data Google was now collecting and that it had a negative impact on Smart Bidding.

They countered that if our goal was to maximize the data for Smart Bidding, we should move to 90 days. So we did.

This was the first time we had moved such a large account to a 90-day conversion window.

What happened next surprised us.

Changes to ROAS targets stopped having any effect whatsoever. Even doubling the ROAS target didn’t really move the CPCs down.

When Should You Change Conversion Windows?

With this in mind, you might ask whether it’s a good idea to switch to a shorter conversion window.

The answer is maybe.

If you struggle with Smart Bidding not reacting fast enough when you make changes to your ROAS targets, then changing your conversion window to 14 or seven days might be helpful.

But be careful.

If you have so much data coming in after seven to 14 days that Smart Bidding is not reacting to your ROAS target changes, it can hurt you more not getting that data.

Why Not Just Use Conversion Value / Cost by Time?

Conversion Value / Cost by time is another option that many use to combat conversion lag in accounts.

Normally, your conversions in Google Ads are credited to the day the last click happened. By using by time, you’re telling Google you want to credit the conversion to the day the conversion took place.

First, let me tell you when you can use it, and then I’ll tell you why I think it’s a bad idea.

If your ad spend is very stable from week to week, you can use it. But if you have more than a 10% fluctuation, it will be skewed by the spend that you have right now.

Let’s say your revenue last week was $100,000, and your spend was $25,000 = a 400% ROAS by time.

If the revenue and the spend is the same this week, then all good.

But if this week’s revenue stays at $100,000 by time, but your spend is $40,000, it will tell you the ROAS by time is 250%.

That might send you into firefighting mode when there was actually just a bigger demand this week.

The opposite is also the case.

Let’s say the revenue stays at $100,000 by time, and the spend drops to $10,000. Your ROAS by time will be 1,000%. That’s fine this week, but you’ll see a drop in revenue the following week from the lower marketing spend this week.

All of this can send you spiraling.

That’s why I’m not a fan of using by time to calculate conversion lag.

2 thoughts on “What Every CMO Should Know About Conversion Lag & Smart Bidding”

Great content Andrew. Thanks

Pure gold as always 🙂

We’ve been encountering the very same issue with the Christmas season coming up very fast. Every week we are spending for example +20%, but ROAS is getting worse at first sight. After a week it’s clear that the ROAS remained the same, the investment only needed to take it’s place.