Summary

- Great Google Shopping campaign structures use priorities to tell Google what products are most likely to convert

- There isn’t a one-size fit all structure, but some work better than others most of the time

- Start simple, and expand in complexity as you go

- Standard Shopping campaigns with few ad groups, few products and manual bidding do not work.

The Big Picture

Our first article on Google Shopping campaign structure was solely focused on the query-split framework, which gives you some control back over the search queries you’re bidding for in Shopping.

But we always received the same question:

What if we don’t carry any known brands, or if we don’t have significant performance difference across keywords?

Since 2017, we’ve experimented with new campaign structures for Google Shopping, and we felt it was about time to write more of an introduction to the various campaign structures you can use rather than jumping straight to a single tactic.

Two Takes on Campaign Structure

Before getting started I wanted to mention that even though this might seem complex, then you just have to start somewhere.

I have seen many examples of campaign structures that were overly complex. The more complex you create a campaign structure, the harder they will be to manage.

Overly complex setups can be a challenge to manage for even the best of us. Even though a complex structure might be best in theory, then your optimizations will be less effective and you will end up with sub-optimal campaign performance.

If you feel this article is too advanced, then just start with one Google Shopping campaign and focus on structuring it correctly using the ad group and product group section.

Then you can expand further afterwards.

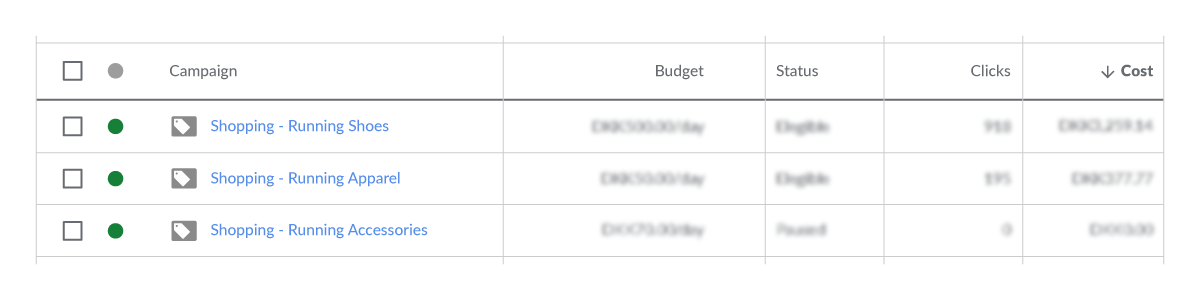

When to split in different campaigns

We think of two different ways when it comes to using different campaigns

- Segmenting products into different campaigns

- Creating different campaigns, and use the priorities setting to influence what products (or search queries) are being prioritized

To summarize our stand on mobile-only campaigns: Only segment your campaigns in mobile vs desktop when there are significant performance differences that you can’t manage with bid adjustments.

Cases for Segmenting Products into Different Campaigns

You need a good reason to split into separate campaigns. Don’t do it just because you do it with your regular Google Search campaigns. The biggest challenge is that they are not as easy to manage.

Search campaigns require a very strict structure to ensure relevance from search query to keyword to ad to landing page, but you don’t have the same issues in Google Shopping (to a certain degree).

With that being said, then there are several good reasons to segment products in separate campaigns:

- Low vs high value products

- Seasonality

- Breaking up large inventories

- Separate ROAS targets for margins

- New vs existing products / categories

I’ll touch on each campaign segmentation below:

Low vs High Value Products

If you sell both products at high ($500+) and low ($20) price level, then you should consider segmenting them. This enables you to treat them differently from a bidding perspective.

The journey for a high value product is significantly higher than if you are buying something worth $20. This should be reflected in your bidding frequency and performance analysis.

We’ve scaled accounts by simply creating this segmentation and given high value products more time to convert.

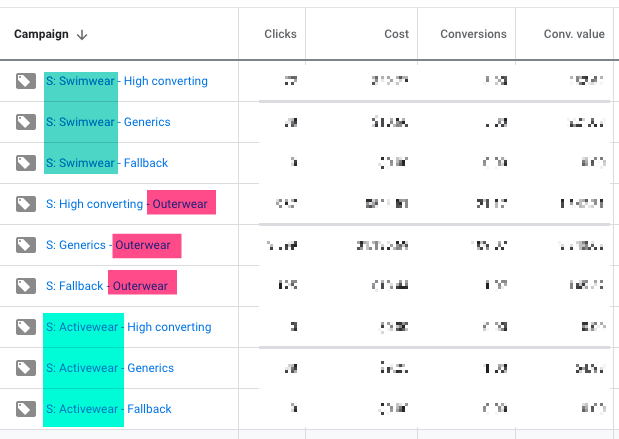

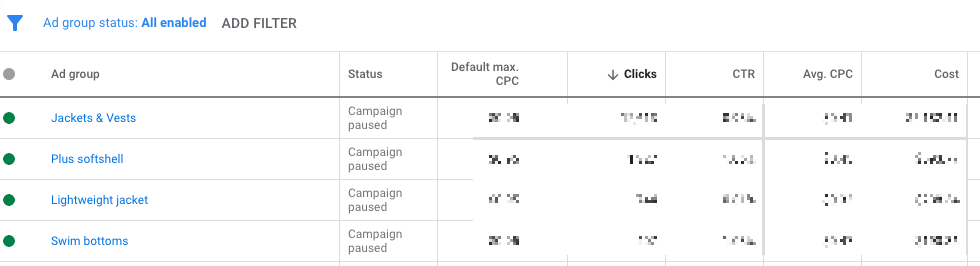

Seasonality

This might be one of my favorites.

Let’s take an easy example such as summer vs winter products: swimwear and outerwear.

Both have very significant peak seasons that you need to be on top of.

By splitting the products into separate campaigns it becomes much easier to compare performances year-over-year and notice trends.

Like in the following example where we run three different campaign “groups” for three different apparel categories:

- Swimwear is a focus area in the summer.

- Outerwear is a focus area in the winter.

- Activewear goes up and down throughout the year.

Breaking up large inventories

If you’re selling more than 20,000 products it’s often a good idea to segment your products into separate campaigns based on main categories.

If we take my favorite grilling site, BBQGuys.com, then they have the following categories:

It would most likely make sense to split up the main categories that you see in the top of the site – both due to the size of the inventory, but also due to the high vs low value argument.

You could even argue that an ecommerce store of that size requires further sub-grouping.

Separate ROAS targets for margins

Even though I’m a big proponent of profit tracking, then in cases where that’s not possible and you have big discrepancies in margins it will make sense to split products into campaigns based on the necessary ROAS target.

Just don’t overdo it. Stick to two, maybe three segments (campaigns). Otherwise you are diluting your data too much.

New vs Existing Products / categories

This is another favorite of mine.

If you are adding a lot of products/categories/brands to an already big site you might want to keep your existing campaigns separate. You’ll want to track the performance for new products, make sure they have sufficient bids for a month or so before you start bidding down.

You also need to work more on negative keywords than you need to with your existing products.

Lastly, if you are using any bidding automation, then you don’t want new products that potentially don’t perform well influence how your automation bids for the existing products.

Your automation is told to hit a target for your entire campaign. So if you are getting a significant amount of new products that pulls down the ROAS for the campaign your automation will decrease bids for profitable products to make up for the rest of the campaign as well.

What About Creating a Campaign per Brand or Category?

This could be where you create a campaign per brand or per category on our website.

I’ve seen segmenting into categories work a couple of times, but brands often becomes a mess IMO.

My personal opinion is that I’ve rarely been able to justify a completely category segmentation (as in +50 campaigns) vs using ad groups to separate sub-categories. So we don’t do it.

We advise a couple of in-house teams that have decided to use that approach and we haven’t found enough of a case to recommend that they switch it. So if you are already doing it today and manage your search queries well (see later in this article) then there isn’t a big case for changing it.

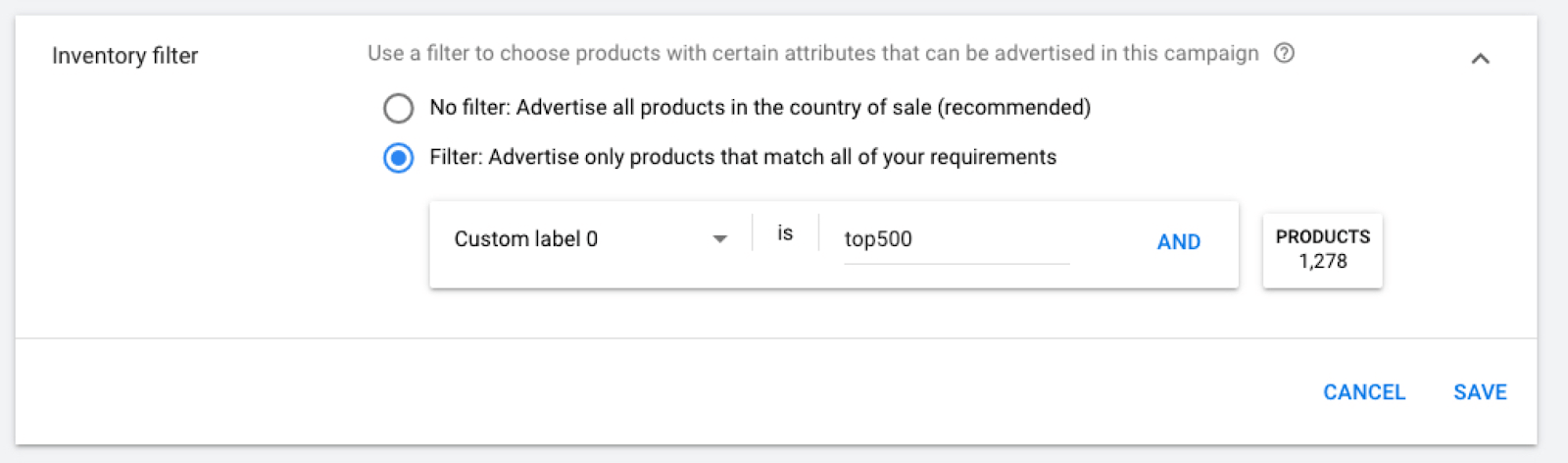

Use Campaign Level Inventory Filters

When you segment categories/brands/products into separate campaigns the best way is to use campaign level inventory filters.

It’s the best way to ensure no mistakes are made when targeting various campaigns:

You find this in your campaign settings.

Campaign Priorities is Your Secret Edge

I was debating whether to leave campaign priorities in the playbook section, but decided to include it here as it’s fundamental to success with Google Shopping.

How to properly use priorities was a riddle for a while back when Shopping campaigns were introduced. It was that setting you looked at and just set to high because, well, high must be better than low, right?

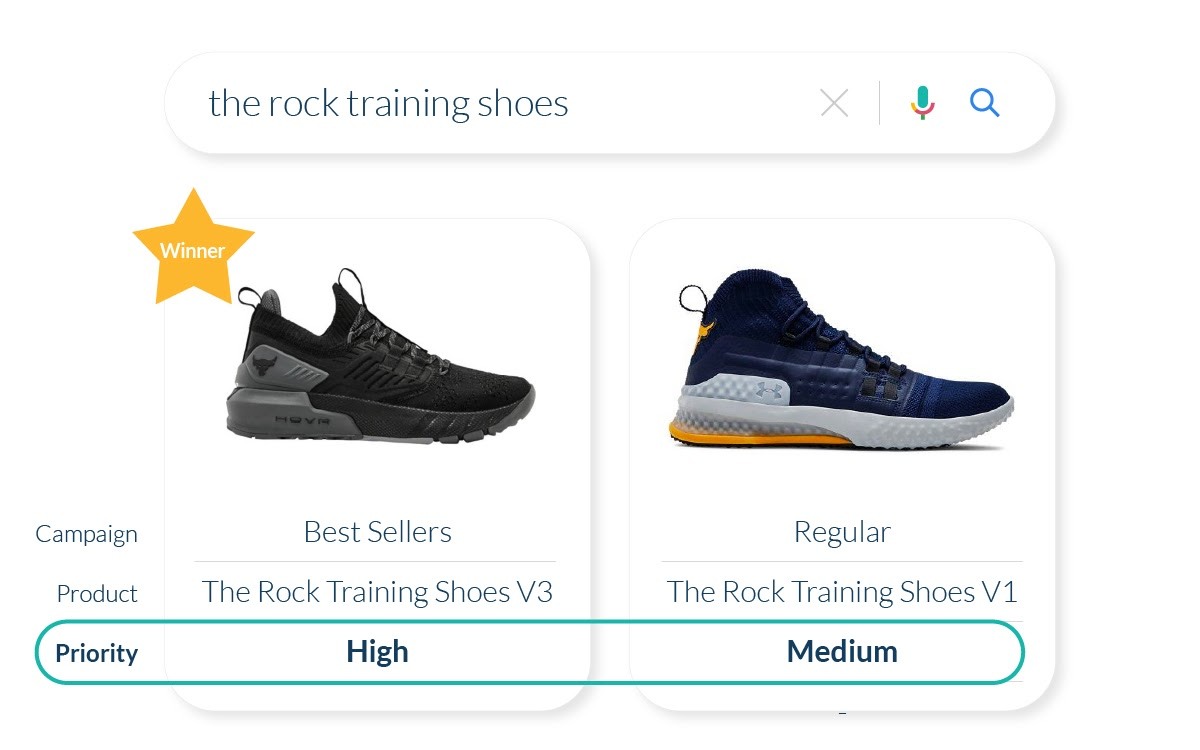

The priority setting works internally in an account.

If you have two Shopping campaigns that can both show ads for the same search terms the Shopping campaign with the highest priority (usually) win (usually because it’s not 100% accurate).

This is the basic idea for Google Shopping campaign priorities.

The setting allows you to create some pretty intricate campaign structures that will set you up for success.

It’s not an exact science, but more of a gentle nudge.

You’re telling Google: “Hey handsome, I think the products in the high priority will convert better, so please show them first”.

As with everything you’re telling Google it’s not always they do what you want.

But it’s better than nothing.

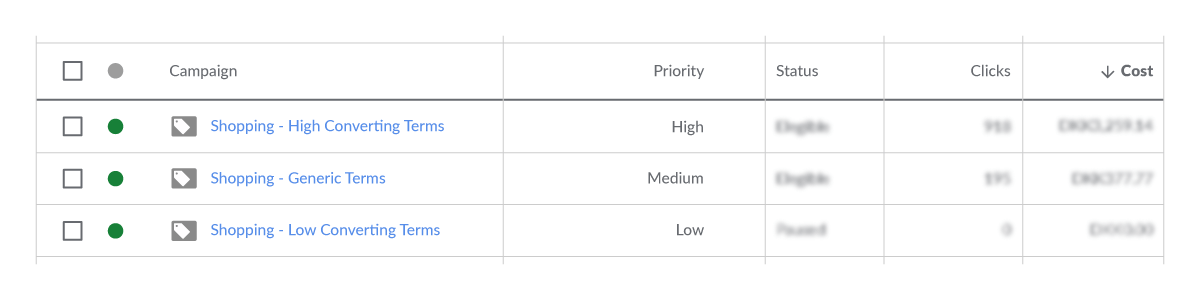

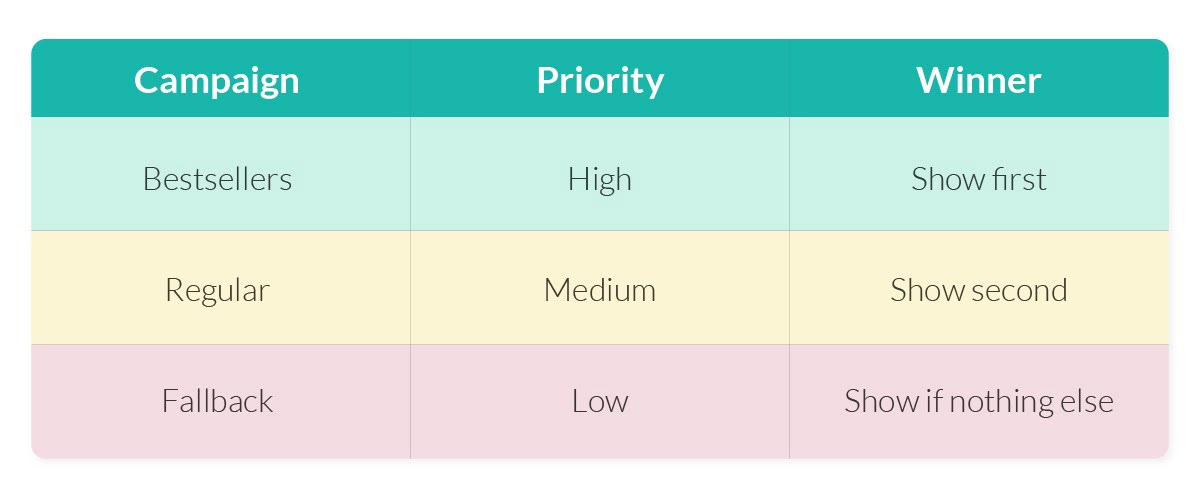

Priorities: The Basics

You have three campaign priority levels:

- High

- Medium

- Low

There are no ad group or keyword priorities.

One thing to note is that Smart Shopping is the ultimate campaign priority that overtakes all other campaigns. So if you have a high priority campaign and a Smart Shopping campaign, products in the Smart Shopping campaign will be preferred by Google.

That’s why you should be careful with running a mix of regular and Smart Shopping campaigns.

7 (8) Ways to Use Campaign Priorities in Your Google Shopping Strategy

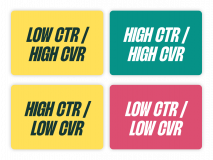

There are many different ways to use campaign priorities, but the base of it all is that you if you can identify a factor across all / most / many of your products that can indicate how well it will convert, then you can use campaign priorities to prioritize those products.

Here are 7 examples of real-life campaign setups we’ve run:

- Keyword/Query Split

- Bestsellers

- Cheapest

- Variants

- Margins (not preferred)

- On Sale vs Not on Sale

- New vs Old

Seeing that you can’t use multiple priorities, then you can only selling one tactic per campaign setup. You can’t combine the query split and the bestseller tactic.

Keyword Split / Query Split

We’ve written about this extensively in a separate article about the keyword split Google Shopping structure: Regain Control of Keywords in Google Shopping.

The premise is that you use a combination of campaign priorities and negative keyword lists to separate your search queries into separate campaigns.

This allows you to bid higher for search queries that convert well, and bid lower for search queries that convert low.

It works great for advertisers that have clear patterns where some search queries convert better than others. Typically, this is branded searches (i.e. The Rock training shoes) vs generic searches (training shoes).

The challenge with this approach has always been; What if we don’t carry any brands or our generic searches are also valuable?

You can still use query split campaigns for those cases, but sometimes it’s better to use one of the 6 other tactics.

Bestsellers

This is a classic tactic that tends to work well across a number of advertisers.

It’s more successful with DTC brands than any other. If you carry 20 different winter coats, but always sell most of the top 3, then prioritizing these can work beautifully.

Just be aware that you need to select the bestselling product that also represent a good percentage of your revenue. It needs to be at least 50% of you revenue.

Anything less than that and it’s not sufficient enough to work, which is perfectly fine. The strategy is not for all. Many eCommerce stores with a lot of brands thrive of long tail and width. Not going all in on a couple of bestsellers.

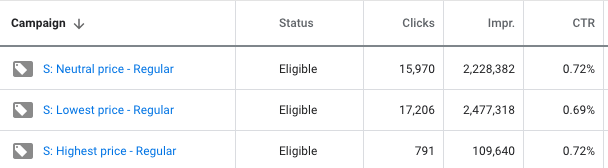

Cheapest compared to competitors

If price is a significant factor in whether your product sells, try showing products first where you are sure your price in the same or cheaper than your competitors’.

Variants

If you often sell out of popular colors/sizes, consider creating a split where products with less than 60% of colors/sizes available are put in a medium priority campaign.

Margins (not preferred)

You can create a campaign structure that has high margin products in a high priority, so you show products with the best first.

This can be impactful if you sell private label products mixed with other manufacturers’.

On Sale vs Not On Sale

Some stores have a consistent promotion schedule that dictates what product sells or not. If that’s you, you can try prioritizing products on sale as high.

Just don’t do it if your promotional strategy is to sell your out of season products. It will result in you showing your out of date inventory first, which might get the least CTR and clicks.

New vs Old Collections

Especially in apparel, new collections sell better than old collections. You still want to sell out of your old collections and if consumers are specifically searching for the old collection.

You just want to prioritize your new collection.

But the priority tactic can really be used for anything you can define as a factor in the conversion:

- Fast vs slow shipping

- Cheap vs expensive shipping

Before you create any split then use the Google Ads Reports to verify that there is actually a significant performance difference between products with the factors that you want to create a split based on.

This can be done by creating a custom label for the product segmentation you want to create, and let it run for a month. You can then use the Google Ads Reports to check the performance difference between the custom labels.

This is a very powerful way to verify new campaign splits before you start creating them.

Ad Group Structure

Before we dig into this, I want to specify what difference between an ad group and product group is:

Ad groups contain product groups.

Ad Groups:

Product groups:

Product groups are a way of grouping products together. This can be done in any way you want.

Typically, you’ll create product groups based on brand, product_type, price, profit margin or another attribute.

Finally, a product group can also be a single product.

When managing Shopping campaigns, splitting your products into multiple ad groups within your campaigns can be a sound strategy.

Two of the biggest advantages of multiple ad groups are:

- Stronger control over bid adjustments (RLSA, Mobile, Ad Schedule) as you can set a bid adjustment on the ad group level

- Better insights to what search terms specific product groups appear for

Since there is no way to see what search terms a product group is appearing for the only way to get more insight is by splitting your product groups in individual ad groups.

Depending on how many products you have, this can become a time-consuming task.

Especially if you split your campaign in mobile too. Optmyzr has a super simple tool that allows you to do this with the click of a button (Check out my free step-by-step guide to setting this up.)

Product Group Setup

In regular search Ads you have keywords. The equivalent of a keyword in Shopping Ads is a product. A product group consists of a group of products (or just one product).

You can set a bid on the product group level.

The difference between keywords and product groups is that you can’t really control what search terms you’re bidding for with a product group.

As default, Google will create a single product group that contains all your products:

It’s crucial that you split up your product groups is a way that makes it easier to bid for each individual product based on its performance.

Again, using the same screenshot from above, we can show how an All Products product group has been broken up by sub-categories:

It gives us the ability to set bids based on the performance of each individual sub-category rather than an average of all products.

You Can’t Bid Effectively With One Product Group

The main reason why you want to set specific bids for individual products, or product groups consisting of a few products, is due to the performance varying from product to prodyct.

Let’s look at a couple of examples:

Some products have a 1,000% ROI while others have a 300% ROI. You want to set a separate bid for each of these.

Some products require a $3 bid to maximize their impression share. For others, just $1 or even less will work. The “magical” S-curve in bidding is crucial when it comes to bidding on individual products.

Some products do well on mobile. Others don’t. This is where splitting product groups in different ad groups or campaigns come in.

Some products should be excluded completely. Others shouldn’t.

If you don’t split up your product groups, there is no efficient way of discovering these differences or acting on them with your bidding.

Real Life Example of Advertisers Not Using Product Groups

I’ve run across many cases where the product groups weren’t adequately broken up.

Often it’s because the overall results from Shopping are pretty good.

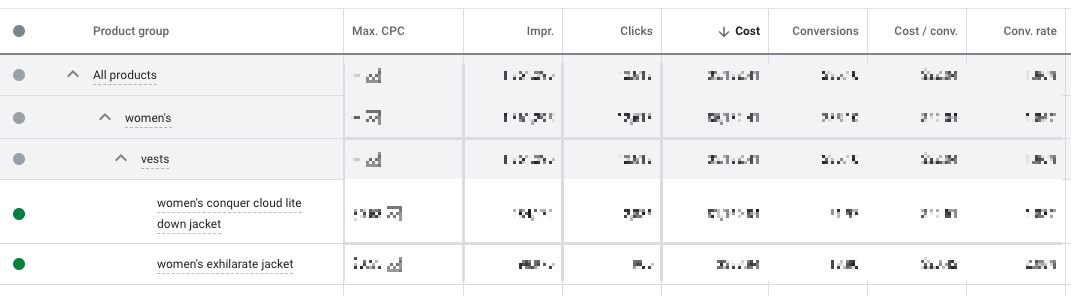

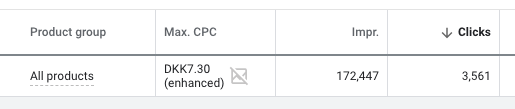

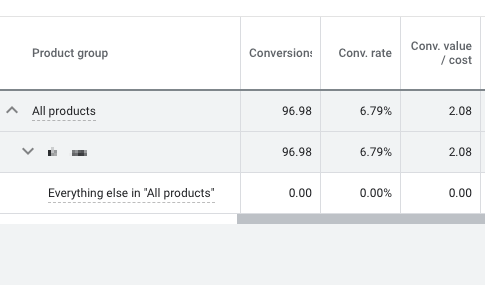

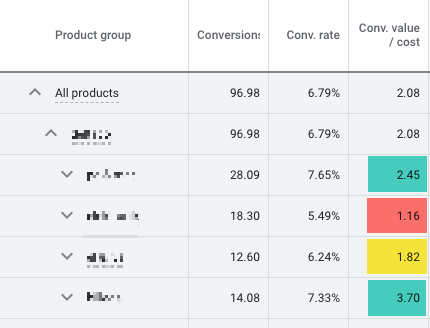

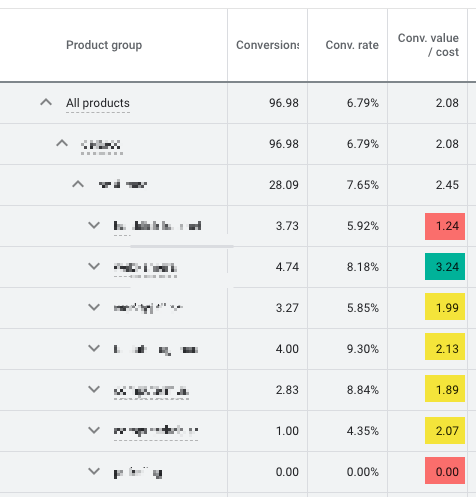

In the example below you can get a better idea of what I’m referencing.

The overall performance is 2.08 ROAS, but when we start breaking down the individual product groups you can start seeing that there are specific product groups that aren’t performing as well as the others:

Main Product Group

First product group breakout:

Second product group breakout:

You’re starting to get the idea, right?

By breaking up the product groups again and again, you can start seeing that certain product groups, or individual products, don’t perform as well as the others. When you don’t break up your product groups you lose the ability to see this.

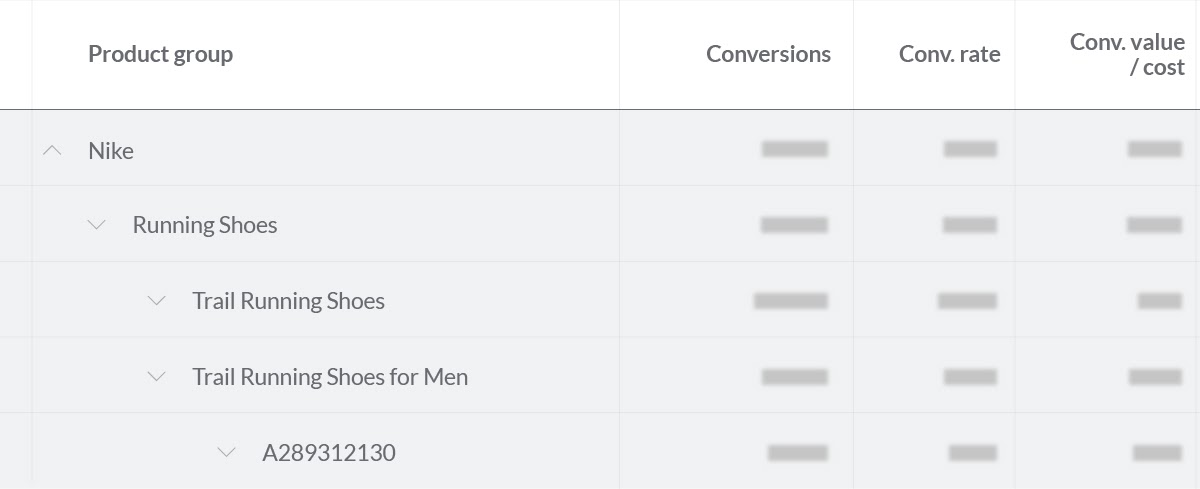

Ideas for splitting product groups

Product groups are split up in layered groups. This means that you split up product groups within a product group.

You can essentially split out product groups based on whatever you want.

My favorite way to split them is typically like this:

- Brand (usually as an individual ad group)

- Product Type level 1

- Product Type level 2

- Product Type level 3

- Item ID

- Product Type level 3

- Product Type level 2

- Product Type level 1

It looks like this in practice:

Some other interesting ways to split product groups can be:

- Pricing (via custom label)

- Margin (via custom label)

- Brand

- Other commonalities

The playbook

Combining The Factors: Priorities and Bidding

You might be wondering how you can select just one priority.

Many ecommerce stores will see that product variants, bestsellers and price competitiveness are all important factors in whether a product converts or not.

The solution is to choose one major factor that you use for your priority campaign structure, and then you use the other factors as your product group structure for different bidding.

This might that you choose the Bestseller vs Regular campaign structure, but use Price Competitiveness at the product group level, so you can change bidding based on how competitive your pricing is.

It will look like this in practice:

- Campaign: Bestsellers with high priority using an inventory filter to only include products with the custom label bestsellers

- Ad Group: Running Shoes

- Product Group: Lower Price – $1.5 bid

- Product Group: Neutral Price – $1 bid

- Product Group: More Expensive – $0.5 bid

- Ad Group: Running Shoes

- Campaign: Regular with Medium priority using an inventory filter to only include products with the custom label Regular

- Ad Group: Running Shoes

- Product Group: Lower Price – $0.8 bid

- Product Group: Neutral Price – $0.5 bid

- Product Group: More Expensive – $0.2 bid

- Ad Group: Running Shoes

Campaign Priorities and Smart Bidding

One of the main reasons to use campaign priorities is to get a leg up from a bidding perspective.

If you’re using Smart Bidding most of the structures still make sense. The only one that usually don’t make sense to use if you have Smart Bidding enabled is the keyword split.

Seeing that Smart Bidding is bidding on a search term basis in Google Shopping (yup, it’s unfair and pretty cool), then there is typically not a need for you to split campaigns due to search queries.

There are a couple of exceptions though:

Generic vs branded search queries: You might want to see a higher ROAS target for your branded search queries than generic/category searches. Campaign priorities would be a beautiful way of doing this.

Gather high converting search queries in one campaign: This is especially effective for high volume accounts.

You have a list of high converting search queries (or low search queries) where you can create a query split where you let Smart Bidding run on the well-performing queries and you set a steady low bid for the lower performing search queries.

And there are more examples where it makes sense. You just have to have a meaning behind doing it.

Priority Levels Aren’t Perfect

Even if you set a high priority and a medium priority campaign, you’ll still see a lot of search queries show up in your medium priority campaign that really should show up in your high priority campaign.

We’ve done quite a bit of testing on the issue and we don’t have a definitive answer.

It’s definitely related to some sort of “ad rank”, but exactly why the priority level wouldn’t override this we don’t understand.

What we do know is:

The closer your bids are to each other in the medium and high priority campiagns are, the more search queries will move to medium priority.

You need at least 25%, and preferably more, higher bids in your high priority campaign to have minimum overlap.

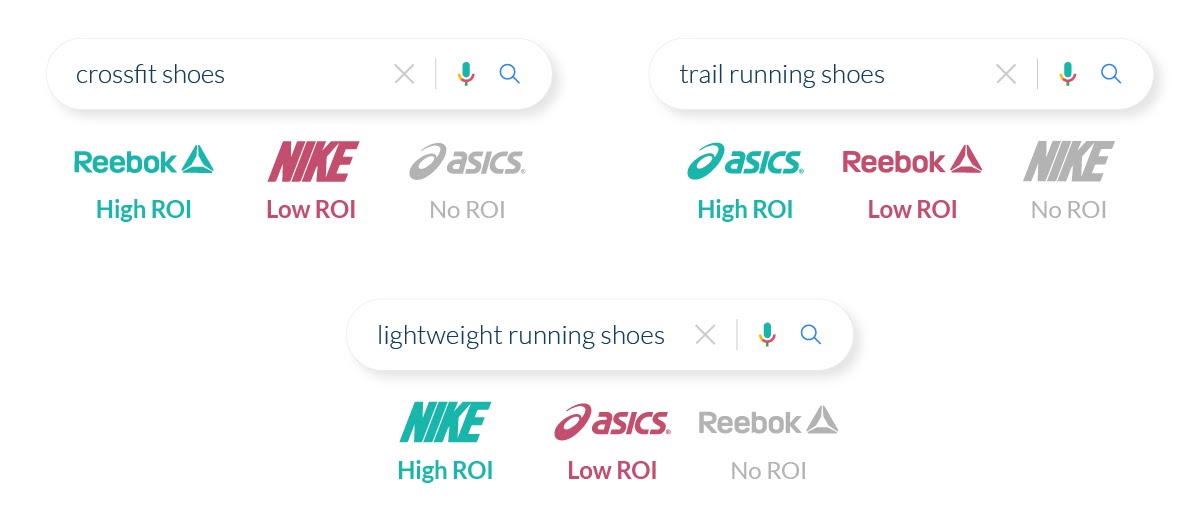

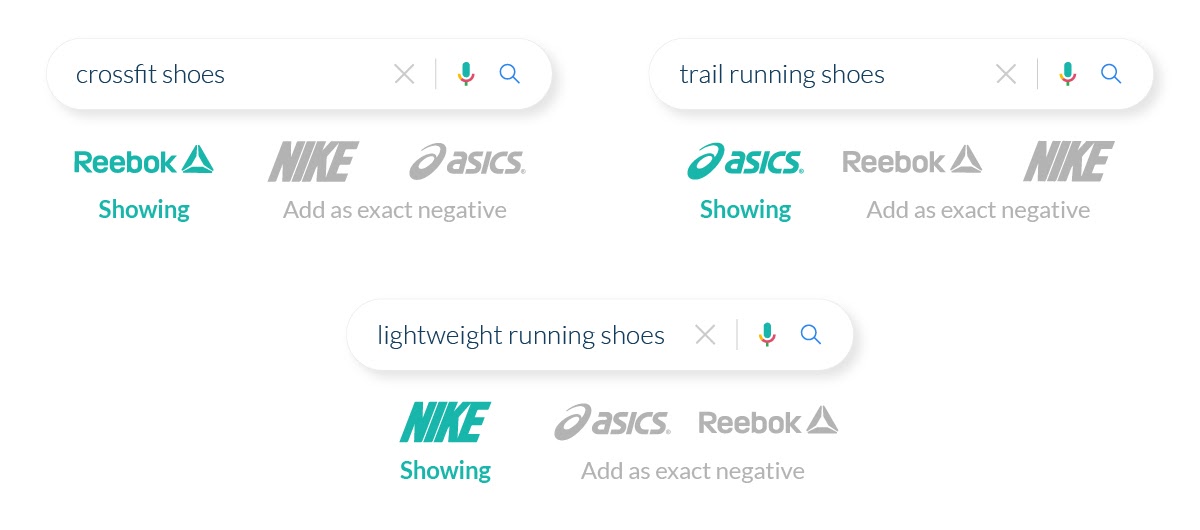

Search Term Sculpting with Ad Group Level Negatives

When you have multiple brands that carry the same categories you want to create individual ad groups for specific product groups/brands so they can own a keyword:

Let’s say that you have Reebok, Asics and Nike athletic shoes.

You’ve discovered that Reebok sells the best for searches for crossfit shoes.

Asics sells best for trail running shoes

Nike sells best for lightweight running shoes

If you only had one ad group, there would be no way for you to determine what brand/product should trigger what keyword. For single-brand advertisers, this is a non-issue, but if your store carries many brands it can become a huge issue.

By creating an ad group for each brand, you can exclude the wrong search terms from the ad groups / brands that you don’t want them to show for:

SPAGs: Single Product Ad Groups – Worth The Time?

I hate saying something isn’t worth doing as I can think of a couple of cases where it makes sense to use SPAGs.

However, to illustrate how little we use them, then we don’t have them running across +50 accounts.

The purpose behind SPAGs is that you can see exactly what search queries appear for individual products. With that knowledge you can really sculpt your search queries to match the correct products.

That sounds good, but in practice there are a couple of problems:

- Search query sculpting is not really that big of a deal many markets

- Google is pretty good at it

- If it’s an issue then sculpting is usually sufficient at the product type level (if you’ve set them up correctly)

- Negative keywords become a niiightmare to keep track of for large accounts

Again, all advice is relative. I’m talking from a perspective of running eCommerce accounts with more than 1,000 products.

If you have 20 or 50 products it might be worth your while.

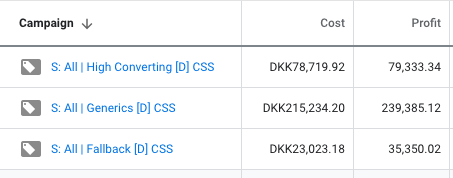

CSS: Comparison Shopping Service

Only applies to Europe.

If you don’t understand what I’m referring to below just ignore it. It’s only important if you know what I mean. We have an article coming that goes into depth with how to work with Google Shopping and CSS in Europe.

This topic deserves its own article, but I’ll touch on it briefly.

There is a theory (which we have neither verified nor debunked) that to get the most out of your CSS Shopping campaigns, then you need to run both Google Merchant Center campaigns and CSS campaigns side by side.

You apply a -18% bid adjustment for the CSS campaigns, set equal bids in both campaigns and then Google will show the product with the best ad rank.

That’s the theory.

And we do it a lot. But only because our software allows us to aggregate the data and then our bids across both campaign types.

But if you can’t aggregate the data, then it becomes really tough to manage and dilutes your data hence making your optimizations less efficient.

For me, less effective optimizations will quickly erode any gains you get from running both campaign types.

Try Once, Try Twice, and Then Try Some More

Seeing that you have to decide on one campaign structure at a time you can’t really try different structures and find which one works best.

But if you have only tried one Shopping strategy in your lifetime, then you might be leaving a lot of money on the table.

We regularly revise our Google Shopping strategy (and therefore campaign structure). Sometimes we change it and often we don’t.

The times where we do decide to make a change is when the current campaign structure does enot support the eCommerce store’s strategy.

For instance, if they go from being focused on being the cheapest on the market to not. Or when they go from using a lot of promotions to rarely using promotions.

We have a campaign structure that fits each business strategy.

How is your Google Shopping structure supporting your business strategy?

33 thoughts on “8 Google Shopping Campaign Structures Using Priorities (Advanced)”

Hello, we’ve attempted your branded campaign scenario and have run into major issues.

Namely, Google is just choosing not to serve any ads from our account for searches containing brand terms at all.

Rather than skipping the main “generic” campaign due to constraints and having the traffic filter to the medium priority “brand” campaign, we are just not getting that traffic at all.

Google help has advised that this is unavoidable and your strategy simply will not work. Please advise.

Hey Randy,

Love the Google advice 🙂

It works. I think you just might have to double-check the way you’ve set the priorities.

Remember that your generic campaign needs to have the high priority and the brand terms as negative keywords.

The Brand campaigns needs the medium priority and no negative keywords..

Also, remember that you shouldn’t change what products are active in the campaigns. All the active products should be the same in both campaigns.

The setup is alive and well in almost all our accounts.

I’m going to shoot you an email too 🙂

Thanks

I’m in a similar spot as Randy. When I search for some of the brands my store offers, I am not seeing any of my ads at all.

It seems as if all I’ve done by following this campaign structure is cannibalize my branded campaign for the generic one.

Hi Brian,

What have you done exactly?

Feel free to write me directly.

I’ve set up four of these campaigns since releasing this blog post, and they work every time.

There is no cannibalization as the search terms appearing under the branded campaign is not the same as the ones appearing under the generic campaign.

There can be a number of issues with your brands not coming up.

The two most common ones are:

1) You made a mistake when setting up your campaign priorities

2) You’re not bidding enough

3) You’ve misunderstood the premise of the way to set up these campaigns and have excluded products rather than working with negative keywords.

With a store like usesi, then this approach will be highly effective when you get it right.

/Andrew

Hello Andrew,

Thanks for a very insightful blog post!

I’m currently thinking about testing this structure out for one of my accounts. But I have a few concerns which I was hoping you could help me shed some light on.

1. Is it correct that all 3 campaigns should have the exact same setup in regards to ad groups? Set up being 1 ad group per brand in your e-commerce store.

2. In a specific ad group. Do I exclude the “Everything else in “All products”” product group, while having a second product group being the brand itself?

3. When applying the strategy in regards to campaign priority and bidding. What will take presidency when it comes eligibility to serve an ad for a query? For example; Query being “running shoes”, if campaign 1 (with prio high) has a lower bid then campaign 2 (prio mid) will this query ever be eligible to run in campaign 2 due to the fact that it has a higher bid?

4. When applying the negative kw list for brand. Is it preferable to use phrase match?

Best,

Martin

Hi Martin,

Thanks for your comment!

See my responses below:

1) The lowest priority campaign doesn’t necessarily need to be as well-structured as the rest. It can just be one ad group for all your products. If you start getting a lot of traffic in this campaign, then you might want to split it out (or better understand the search terms in this campaign and whether they should really appear here).

2) Everything else but the brand you are targeting should be excluded in that specific ad group.

3) Campaign Priority will take presidency.

4) I use broad match. The difference between broad match and phrase match for negatives is only in the word order, so I don’t bother with using phrase match.

Let me know if that answered your questions, and if any follow ups happen please do let me know 🙂

Hello,

I might be confused but there seems to be a mistake in the chart and campaign structure. So we have 3 campaigns (All Keywords, Brand, Top keywords). Clear enough.

All Keywords = High Prioriy, low bid (+ brand and top keywods negatives).

Brand = Mid Priority, Mid/High Bid (+ top keywords negatives).

Top keywords = Low Priority, High bid (no negatives – executed last).

This way, reversing the Google default priority scheme we can target the bottom funnel. I think the way it is described in the article, you do not achieve the result of segmenting and you are paying the same CPC for your low ROI keywords as for your high ROI keywords. Placing Generic with High piority achieves nothing in my opinion.

Regards,

Martin

Hi Martin,

I think you are slightly confused (without offending anyone).

There are two different options.

The proposed option in this post want all keywords to appear in generic unless we negative it into High Converting or Fallback.

“I think the way it is described in the article, you do not achieve the result of segmenting and you are paying the same CPC for your low ROI keywords as for your high ROI keywords”

Segmentation works using this approach. I’m not sure where the confusion pops in.

Your example would also work. It’s just a different way to skin the same cat. In our approach, we don’t differentiate between a branded term and a top keyword. We just have “top keywords” no matter if they are a brand, model, generic term, product name, etc. It doesn’t matter to us.

“Placing Generic with High piority achieves nothing in my opinion”

Compared to the way you show it, then it’s just a slight change.

Here is how it works with the strategy in the article:

So I’m not sure why that wouldn’t work.

Hi Andrew Lolk,

My shared budget spending is far from exhausted, but the search terms still skipping. I’ve rechecked the settings, priority, negative keywords lists. Everything is fine. It’s even more weird that for same search term, sometime it skips, sometime doesn’t. Would you please help me troubleshooting this. Thanks very much!

Hi Andy,

Double check that you are looking at the newest time frames. Granted that the negative keyword is in place in Generic, then there is no way for it to appear back in the generic. Sometimes a term will skip from high converting to generic, but it’s rare and usually not that impactful.

If the bid in fallback or high converting is substantially higher than the bid in generic, then the search term can skip. It’s mostly seen in fallback campaigns though.

Also, if you run the fallback campaign as a CSS (if in Europe), then the search terms also skip a lot.

Questions: What bidding strategy would you recommend for this setup. And should the strategy be the same for all 3 campaigns (top funnel, middle funnel and bottom funnel). I’m finding that my TOP campaign has really high CPCs for some queries when it shouldn’t be (With tROAS).

The setup still allows you to run your favorite bidding strategy. Whether it’s manual, smart bidding (like tROAS) or something third.

If you lean towards smart bidding I would:

1) Run them separate (but still testing moving to portfolio)

2) Have Fallback be manual bids

3) Potentially set different targets for generic vs high converting.

..

But, one thing to keep in mind is that seeing that Smart Bidding is already bidding at the Search term level, then the three tier approach might be overkill. It might be worth just having a two tier approach. So you have a “Regular” campaign and then a Fallback campaign with low CPCs.

That would simplify the setup, and we love simplifying things here 🙂

Hey Andrew!

This is a great read, thanks for that!

We are currently working on a small project that only has 1 product (with a few variations), but from search term report we see that it appears in various search terms that are relevant/semi-relevant and irrelevant.

We are thinking to adjust your structure so we can more or less control the bids for most relevant keywords (around 10-15) separately. Basically, we want to do it by excluding KWs on an ad group and campaign levels.

We are running shopping ads in multiple countries/languages.

What is your take on this and Will this work from Google point of view?

Hi Arturs,

Yes, it sounds like a perfect use-case for this kind of structure 🙂

Hey Andrew!

Really cool article, thanks!

Wanted to ask question how well will this work if we have only 2 products with very similar search terms?

Generally we appear for search terms that include one of the following words – laptop, monitor, stand, riser (+ adjective – wooden, high, small, ikea etc).

We were thinking to split Campaigns by high/low performing search terms and find it difficult to add/structure negative KWs.

Hi Arturs,

Let me shoot you an email, so I can see how you set it up, and get a better understanding of your challenges.

We’re just about to update this article, so it’d be perfect timing to see where you go wrong 🙂

Hi Andrew,

Interesting read. Do you think with target roas bidding getting better and better we still need this?

Hej Mathijs,

Very good observation.

To a certain point, no – as Target ROAS bidding improves we will not need this.

Even today, this framework is less efficient for markets where the conversion rates between the branded and non-branded searches are close to being the same.

However, for cases where there is a big difference in conversion rates there are two aspects to it that you should consider:

1) It’s a waste of money for Target ROAS to “learn” that non-branded converts worse than branded if you already know this

2) If there is a difference in CVR, you sometimes still want to run the split. Otherwise Google will try to balance the high ROAS of branded with the low ROAS of generic. But in some cases it’s better to just maximize the branded searches, and go for a lower ROAS for generic searches.

Hello Andrew,

Big fan of your articles. Keep up the great work.

We setup a structure as described in one of the previous blogs.

It’s for a shoe store with more than 5000 products (x6 Sizes).

Campaign1 = category level. Brands excluded. Low bids. Prio1

Campaign2 = brand level. Model codes & names are excluded. Medium bids. Prio2.

Campaign3 = product level. No exclusions. High bids. Prio3

We have an adgroup for every brand (x200) to optimize Search queries/negatives.

In comparison with smart shopping we have a much higher impression share and volume. But ROAS arent picking up yet. We’re optimizing negatives and lowering cpc’s (to be more profitabel as we dont need 90% IS).

Would you advice another structure?

Would you suggest smart bidding in this case? Havent tried yet because we use channable and adding or removing adgroups reset learning

We’re planning to use the same structure for Search, via Channable.

Any other

Thank you very much for your time & advice. Mail me anytime.

Kind regards

Arno

Nice update. I’ve been using priorities for some time but did not realize you could layer product groups within an adgroup.

I’ve been using priorities to run generic and high converting campaigns together. Each brand gets 2 campaigns. Each campaign is broken into ad groups and each ad group contains one product (multiple product groups if it comes in different sizes/colours).

One thing that should be working well, but doesn’t is having a portfolio budget. I.e. combining the 2 campaigns (high and low priority) under a single budget. Seems like query sculpting doesn’t work as good whenever I try that. Thoughts?

Actually, the portfolio budget is a requirement to run generic and high converting campaigns (see our article on the strategy here).

The issue arises if there isn’t anymore budget left in one of the campaigns, then the keywords will spillover and rendering the setup redundant.

Thanks, Arno!!

Not initially. The value of that setup is with constant tweaking of negatives and bids. The initial setup often works well, but can often be improved a ton.

In the end it depends on your goals. If you chose the “manual” approach like this one to increase exposure, then stick with it. If ROAS is crucial to you then you should consider Smart Shopping.

Technically, Smart Bidding optimizes at the Search Term level which – to a certain extent – would leave the setup redundant. There are still reasons to do it.

I’d say that if bidding is something you’re extremely confident with then stick with manual.

However, it’s the one area that we often seek to automate as soon as we can. Especially for accounts with 5k, 10k or 50k products. It just gets really tough to do properly at scale while still having a proper return on your time while doing it.

Thanks for another great post. Do you have any timeframe for Google CSS article you’ve mentioned at the end?

Thanks, Silver! My hope is to get it live late January :=)

Hey Andrew,

Love the read! Thanks for the insightful info! I am pondering myself what the purpose of grouping the products by product group is, if you can’t make bid adjustments on device or location, like you can if you create ad groups. It’s just for viewing purposes right? Because if I group by item ID I can bid on each product. thanks!

Hello, I sell maternity clothing and i am having problems in trying to make my shopping campaigns not to show up for normal women clothing searches. I made two shopping campaigns and in the high priority and low cpc one I put as negative keywords searches related to maternity clothes.

For eq in high priority one i have as negative “maternity elegant dress” so i will not pay to much for searches which contain only “elegant dress” . Did i think it right?

Can you please advice how could i use ROAS as biding strategy with these structure, since on my high priority campaign i am not expecting any purchases while in low priority i should have all my purchases happening.

Hi Claudio,

Yes, you are almost there 🙂

Instead of choosing a negative like “maternity elegant dress” I’d just use a negative like “maternity”. That way you tell Google that every time a search includes the word “maternity” and match your product, you want to be shown.

The other way is also effective, but can be very restrictive.

Reg. Smart Bidding:

Once you have enough conversions. (100-200 min. in my opinion), then you can add Smart Bidding (ROAS) to your Low Priority campaign with all the conversions.

Hi Andrew,

This question has been eating my mind. Didn’t know who to ask but then I remembered your blog. So hopefully you see this.

Are there any tools you would recommend that makes this really easy and, more importantly, fast?

I just finished going through your article and I have to comment, it was an undivided pleasure. Your writing technique is engaging and illustrative, making me feel like I was right there with you on your experience. The picture you included were also remarkable and really added to the overall quest. good-luck

Hello Andrew,

I’m currently running 3-4 standard shopping campaigns for a wallpaper business, organized by category, vendor, and color. While I’m achieving a ROAS of 5x, I’m noticing significant overlap in search terms across these campaigns. For example, in the vendor-specific campaign, I’m getting general terms like “wallpaper” or more unrelated terms like “kids wallpaper,” which don’t align with the specific campaign focus.

Each campaign contains a single ad group, with multiple product groups. Could you advise on what might be causing this overlap, or suggest any adjustments I could make to better segment search terms across campaigns?

In general, you can exclude those terms from cannibalizing in the individual campaigns as long as you’re 100% certain the overlap is bad.

I.e. the keyword “wallpaper” is fine to show in the kids wallpaper campaign, but maybe you want kids wallpaper to only show in the kids wallpaper campaign.

Often I see people overdoing this, and it causes problems in the long term. But as long as you don’t overdo it, then adding a few negatives is the way to go 🙂