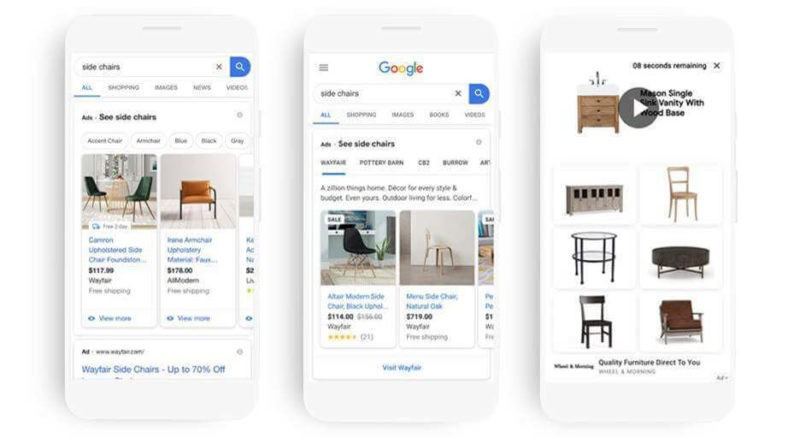

This article has been on my wishlist for a long time. I believe we’re one of the only agencies that still commit at least 50% of our ad spend to Standard Shopping campaigns.

We don’t do this because we’re old school. If that were the case, I’d still do manual bidding.

We do it because Standard Shopping campaigns still work in the right scenarios. Just like we opt for Performance Max campaigns when it’s the right choice.

I strongly believe in the right tool for the right job, and that’s what I will outline in this article, in which we compare Standard Shopping to Performance Max.

I don’t want to start a long list of pros and cons, so instead, I’ll provide a comparison with all the pros of Performance Max and Standard Shopping. This way, you’ll have an easier time figuring out what applies in your scenario and making the right choice for you.

First, let’s go through the advantages of each campaign type.

Advantages of Performance Max

- Supposedly, a stronger bidding algorithm

- You don’t tinker as much

- Potential preference in the ad auctions (not verified)

- A single campaign for ROAS targets & budgets

- Expansion to Search Ads

- Expansion to Display Ads & Video Ads

Supposedly a stronger bidding algorithm

One of the things that Google reps are saying behind closed doors is that Standard Shopping ads do not get any more attention from the engineers at Google. Specifically, they say that there is no one developing on the platform any longer.

They try to use this to say that Std. Shopping Ads aren’t as strong as Shopping Ads inside Performance Max.

I have a tough time believing this for many reasons. One being that Smart Bidding is Google’s core bidding algorithm, and they have plenty of revenue coming from outside Shopping Ads. They wouldn’t ignore Smart Bidding (and they don’t claim to).

But nevertheless, Performance Max is the new platform, and there is no doubt that Google is spending significantly more resources on its development than anything else they do with their ad platform.

This should, one would hope, result in a stronger campaign type overall.

You don’t tinker as much

I see advertisers break things because they make too many changes. Performance Max inhibits the amount of changes you can make, so you don’t get in your own way.

That’s a plus in my book. Unless you know what you’re doing.

Potential preference in the ad auctions (not verified)

This is something that has come from the launch of Responsive Search Ads. In the past, Google has given preference to new introductions in their ad platform.

It would not surprise me if this happened with Performance Max as well. It would be the best way to get the last percentage of advertisers not using Performance Max onboard and then use it as an argument to turn off Standard Shopping.

For this reason, we run a significant part of our portfolio in SavvyRevenue on Performance Max campaigns. Even when we technically could run Standard Shopping campaigns.

We’re scared this might happen one day, and we want to know if there is any form of arbitrage to be had.

A single campaign for ROAS targets & budgets

When you’re running multiple Search, Shopping, and Display campaigns, it can be overwhelming to set the right budgets and ROAS targets. Even just making sure you remember to keep them updated can be tough if you’re not a seasoned PPC marketer.

The original goal Google had with Performance Max was to switch eight campaign types into a single campaign and simplify their ad platform.

They succeeded.

Expansion to Search Ads

I’ve set this one aside from the list because I think it’s a different advantage than expansion to Display & Video ads.

A lot of advertisers used to run Smart Shopping only, so when they switched to Performance Max, they saw a 10-30% increase in revenue with no ROAS downside.

This came from Search Ads inside Performance Max. Many had simply ignored Search Ads for so long that they hadn’t been using Dynamic Search Ads at all, so the DSA campaign type inside Performance Max granted them a quick 10-30% increase in revenue.

I definitely see it as a positive that you don’t have to do anything to ensure you’re shown on Search Ads.

Are there negatives associated with it? Yes, of course. But for the most part, it’s a net positive for new advertisers.

Expansion to Display Ads & Video Ads

On paper, I think it’s great that Performance Max tries to push more spend to profitable placements in Display and Video Ads.

In practice, though, I still think there is a long way to go before it to becomes as big a deal as I’d like it to be.

I feel Google has huge untapped potential to go a step further with their ad platform, but as it stands, it’s still a net positive that you don’t have to create new campaigns for simple retargeting on Display or Video networks.

Advantages of Standard Shopping

- Ability to use Portfolio Bid Strategies (max & min. CPCs)

- Full access to search terms

- Access to priority settings

- You only show for Shopping Ads

- Brand safety is easier

- Access to impression share data

Ability to use Portfolio Bid Strategies

If you create two Performance Max campaigns, you have to manage each individually.

With Standard Shopping Ads, you still have access to Portfolio Bid Strategies, which allows you to do three things:

- Group campaigns together with a single ROAS target

- Set max. CPC bids to lower waste in your account

- Set min. CPC bids to not drop completely out of auctions

I’ve written more extensively about how to use portfolio bid strategies in our Smart Bidding optimization guide.

Full access to search terms

We’re getting better access to search terms in Performance Max than we did in Smart Shopping but the data is still not simple to analyze.

We’ve done extensive analysis on search terms for large eCommerce stores and found that sometimes we can save 5-8% on search terms that were statistically significantly wasted over a year.

For an eCommerce store spending $2,000,000 on Shopping Ads per year, this amounts to $100,000 to $160,000 of extra margin.

We love it.

Access to priority settings

The priority setting (High, Medium, Low) has long been the core of why we still have Standard Shopping Campaigns as part of our framework at SavvyRevenue.

It allows you to create campaign structures that tell Google to show high-priority ahead of medium-priority products. This allows you to create campaign structures that can help the algorithm perform even better.

I’m including this as some of my main scenarios for Standard Shopping Campaigns below.

This is different from simply creating multiple Performance Max campaigns. Since these are equally weighted, you’ll have to set different ROAS targets for each campaign, which isn’t always preferable.

You only show for Shopping Ads

We’ve run Performance Max campaigns for mid and large eCommerce stores where we see a sudden increase in Display or Video spend.

It usually happens when we’re trying to grow campaigns and set higher budgets with lower ROAS targets. This is a key tactic of ours that urges Smart Bidding to search for more ad inventory we can be shown for.

Often, we’ll still stay within our ROAS targets for the account when we do this with Standard Shopping campaigns.

However, with Performance Max, we see that Smart Bidding takes the increase in budget and decrease in ROAS target as a sign to go into:

- Display Ads

- Video Ads

Which, in all cases, do not result in an increase in reach on Shopping Ads. ROAS declines, and we often end with the opposite effect (the campaigns become even more narrowly focused, so revenue decreases).

You’ll not have this issue with Standard Shopping Campaigns. For this reason, we’ll often move accounts where we run Performance Max to Standard Shopping if this becomes too big of a restriction in our ability to grow an account.

Brand safety is easier

We work with pharmacies, big brands, and others where brand safety is a weekly conversation.

Performance Max is currently a very difficult entity to work with from a brand safety point of view. I get it. It’s not a thing for 90% of people reading this, but if brand safety is a concern in your business, then it’s a big concern.

Knowing that your ads will only show for Shopping Ad placements can be very helpful.

Access to impression share data

Performance Max does not include access to impression share data. Not in the interface or via the API.

I can understand why. How do they report a joint impression share for Search, Shopping, Display, YouTube, and Gmail?

The answer is that they should just report on it separately, but in any case, we don’t have the data.

Knowing your top impression share metric (i.e., how often you show in the top four spots) is key to analyzing how much room you have to grow.

It also helps to answer the following questions:

- If we decrease our ROAS, how much more revenue do we expect to achieve?

- If we decrease our prices, do we think we can get better placements with more traffic?

- Are we maximizing Shopping Ads? If yes, we can set realistic growth targets.

We love using impression-share data, and losing it when switching to Performance Max is one of our key considerations.

With the advantages of each campaign type out of the way, we can go into what scenarios work best for either campaign type.

Scenarios for Performance Max

- Single campaigns

- Accessory products (Simple DTC brands)

- Bestseller/New/Sleeper/Unprofitable

- Secondary countries: Search + Shopping

Note that I’m not fully onboard with the idea that Performance Max does amazing with Display or Video Ads. All the scenarios below, therefore, use a feed-only Performance Max setup (meaning it focuses on its Shopping Ads ad format):

Single campaigns

If you’re not using the priority settings in Standard Shopping, then I’d almost always recommend running Performance Max with a feed-only setup.

The times we’ve tested single standard Shopping campaigns against a single Performance Max campaign, it’s usually been P-Max that performed the best, or at least it’s been 50/50.

If it’s 50/50, then I’d prefer to give Google the benefit of the doubt and bet they’re working on the platform to improve it — which you can take advantage of if you’re running Performance Max.

Accessory products (Simple DTC brands)

If you’re a DTC brand, you’ll often just have 1-2 campaigns (unless you fall into the other scenarios below), and then Performance Max is the preferred choice.

Bestseller/New/Sleeper/Unprofitable

This kind of setup is called many things, but the essence is the following:

Your products are categorized in the following buckets:

- Bestsellers

- New products

- Sleeping products

- Unprofitable products

Because of the way the algorithm works, you can grow your Performance Max campaigns by putting each of these product categories in individual campaigns.

When all the products are grouped in a single campaign, the following often happens:

- Bestsellers ROAS are too high, resulting in less-than-maximum exposure

- Sleeping products get very little spend, so the algorithm doesn’t notice when it’s time to prioritize them again

- New products don’t get enough traffic to prove their worth to the algorithm, so they quickly become sleeping products

- Unprofitable products get some conversions but at an unprofitable ROAS-level. This pulls down the overall ROAS of the campaign and further relies on bestsellers to be at a too-high ROAS level

To combat this, we’ll take advantage of the fact that individual Performance Max campaigns work as silos, so we’ll set the following targets:

Bestsellers:

- Top 5/10/20 in category

- Set to a profitable ROAS target

- Unlimited budget

This results in maximum exposure at profitable ROAS.

Sleeping products

- <10 clicks over 30 days

- Set to maximize conversions

- Limited budget

This results in low-click products to get some data for Smart Bidding.

New Products:

- New products in the last 30 days

- Set a sub break-even ROAS target (or)

- Limited budget

This results in new products building a funnel and data for Smart Bidding to turn into bestsellers.

Unprofitable products:

- Sub-profitable ROAS over 30 days

- Set a break-even ROAS target

- Limited budget

This results in spending on low performers without pulling down top performers.

Secondary Countries: Search + Shopping

A typical mistake is having the same campaign structure across multiple countries in Europe.

Your main countries usually have far more volume than secondary countries, so you can afford to split up the campaigns a lot more. But if you have less than 150 conversions per month, you shouldn’t split anything.

Splitting a Performance Max campaign with 150 conversions will result in one of the new campaigns having less than 50 conversions, which will likely cause it to tank completely.

So, in your secondary countries, I’d recommend using a single Performance Max campaign that contains both Shopping Ads and Search Ad assets. Still no Display/Video assets.

Scenarios for Standard Shopping

- Top Impr. Share vs. POAS maximization

- On Sale vs. Not On Sale with the wish to show on-sale products first (rotating sales groups)

- Keyword split campaigns

- Brand Term split

- Private Label vs reseller split

- In-Category Bestsellers (top 5 blenders vs everything else)

- You’ve seen >10% waste on video or display ads

All the scenarios listed here (with the exception of the last one) will utilize the priority setting in Standard Shopping campaigns.

Top Impr. Share vs. POAS Maximization (Contribution Margin)

This is one of my favorites and can also be done with ROAS, but it works best with POAS.

The thesis is simple:

- If we’re at 90% Top Impression Share, it means we’re in the top four ad spots 90% of the time.

- The value of increasing our bids to gain more exposure is low.

- Smart Bidding will increase our bids if the POAS is above the target regardless of the Top Impression Share

- By implementing two separate campaigns, we can apply different ROAS targets based on the Top Impression Share metrics

- This will, in theory, maximize the profit (contribution margin) dollars we get from Shopping Ads

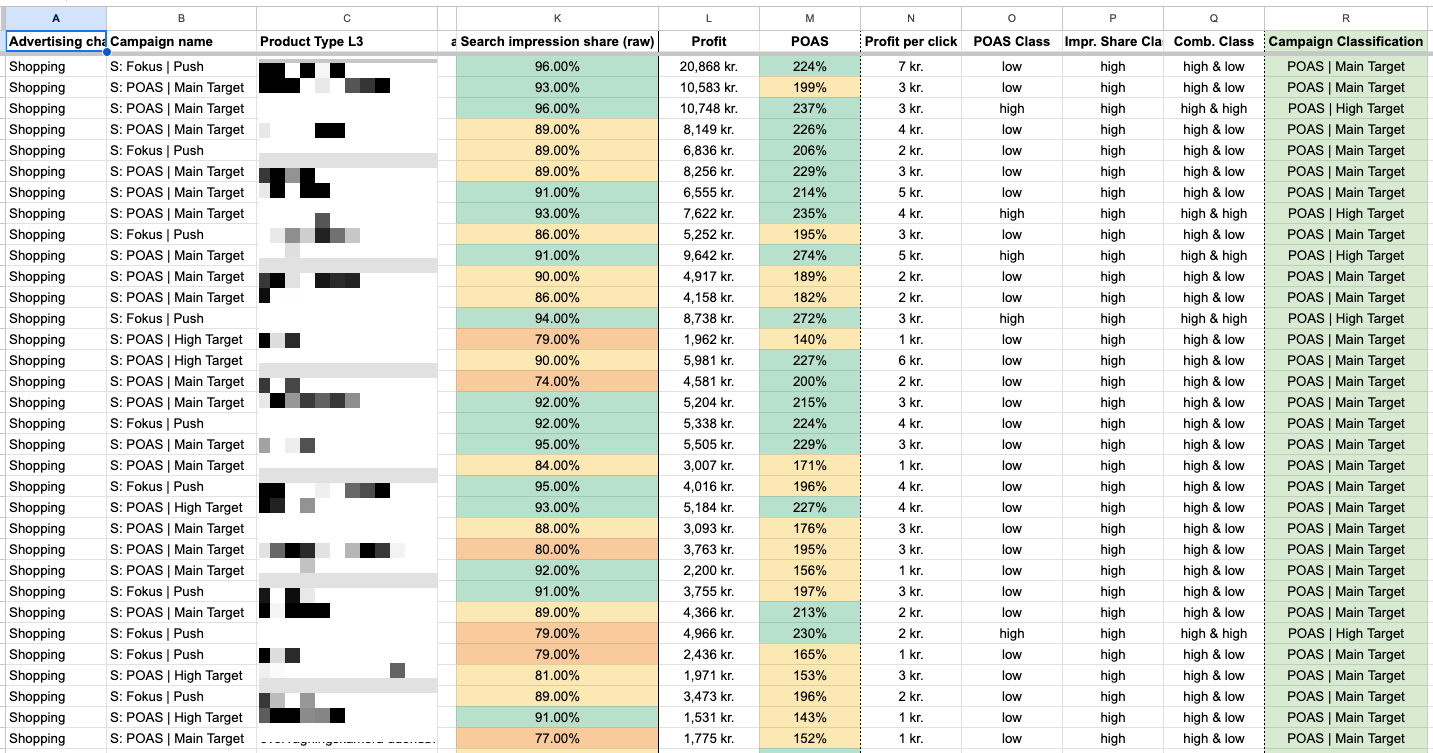

The way we’ve built this is in SuperMetrics (or DataSlayer).

Importing the product data (or, in this case, the sub-category data) allows us to know what the POAS and impression share is for each.

With some simple formulas, we can then decide if a product should go in our Main campaign or our High ROAS campaign.

The figure below, which shows a sub-category with 91% impression share and 272% POAS (avg. is 190% for the two campaigns), is a great example. There is no need to increase CPCs further for these campaigns.

On the other hand, if we have a 93% impression share and a 199% POAS, then moving it into a campaign with a higher target would decrease the bids — and drop us down the rankings, resulting in less exposure and lower absolute profit dollars.

Note: This can’t be done with Performance Max as we don’t have access to impression share data as I write this. We’re investigating if Click Share can work, but so far, we’ve found it hard to define what the optimal click share is for everyone.

On Sale vs. Not On Sale (Rotating Product Sales)

While aiming to show on-sale products first (rotating sales groups), this was one of my first complex Google Shopping campaign structures.

It works amazing for advertisers that always have parts of their inventory on sale.

Let’s say you have the following categories and brands:

- Running shoes

- Adidas

- Nike

- Hoka

- Crossfit shoes

- Adidas

- Nike

- Hoka

- Hiking shoes

- Adidas

- Nike

- Hoka

Whenever a brand is on sale, it converts better.

By creating a dynamic campaign structure, you can proactively:

- Increase bids for products on sale

- Decrease bids for products not on sale

When you usually have these rotating periods, Smart Bidding takes one to five days to understand whether a product has increased/decreased its conversion rate.

In that time frame, you can waste a lot of money or lose out on a lot of potential revenue. The issue is that when all your products are in one campaign, you don’t notice it because it all averages out.

Note: This can also be done if you do the more “shady” product group rotating. Let’s say you’re a DTC brand selling running shoes. You have four types of running shoes, and you rotate them so a group of products is always on sale:

- Group 1: Week 1-3

- Group 2: Week 4-6

- Group 3: Week 7-9

- Group 4: Week 10-12

It’s a beautiful solution if you ask me.

Keyword Split Campaigns

This is an oldie but a goodie. If you ever need to differentiate targets, budgets, etc., based on keyword groups, then you can do it with keyword-split Standard Shopping campaigns.

We use it a lot less today, but there are times when we need to control what keywords get what budget – especially in the early days of a Google Ads account.

Brand Term Split

When you exclude brand terms from your Performance Max campaigns, you should use a Standard Shopping campaign to catch it.

It works the exact same way as the keyword split structure above.

Private Label vs Reseller Split

I love this split for eCommerce stores that have private label products.

The thesis is as follows:

- You’ve created private label products based on your bestselling products from other brands

- Your margins are much better on private label products

- To differentiate the two, you need to split them into two campaigns

- The priority settings work great to prioritize your private label products

The way it works in practice is that you create two campaigns:

- High priority: Private label products

- Medium priority: Other brands

This will tell Google that:

- If a search term matches both a private label product and another brand, it should show ads for the private label product

- If a search term only matches another brand (like a brand search), it should show ads for that particular brand

This has worked great and produces a natural way to scale Google Ads accounts. The higher margin private label products result in an ability to bid for generic/category keywords that didn’t perform well enough to run at scale for the other brands.

In-Category Bestsellers for Large SKU Stores

The exact same structure can be used for in-category bestsellers.

This is a more sophisticated way to run a bestseller split (as mentioned above in the Performance Max campaign suggestions).

The thesis is as follows:

- If you have hundreds of products in a category, Smart Bidding can spend a little on a lot of products, lowering your overall ROAS

- Good keywords (i.e., sports blender) can be focused 80% on your bestselling product at 5% conversion rate, but the other 20% of clicks go to other sports blenders with 2% conversion rates

- This causes you to lose out on potential revenue if the last 20% of clicks would all go to the bestselling product

Implementing a structure like the following will solve it:

- High priority: Top 5 products in a sub-category

- Medium priority: The remaining products

It’s very important that it’s the top 5 products in a sub-category, and not overall.

To keep with the same example, the sports blenders do not compete with the coffee machines. So, it doesn’t matter if you sell a million sports blenders and a thousand coffee machines. Both are technically bestsellers in their category.

You’ve seen >10% waste on video or display ads

Last but not least, and perhaps the most frequent reason we move our bigger advertisers off Performance Max:

The wasted ad spend on Display & Video becomes intolerable.

It’s not that the percentage of spend increases. It’s that when you spend $500,000/mo. on Performance Max, then 1% of the spend is $5,000.

At those levels, even wasting 1% of your ad spend on bad Display placements is a significant amount of money. When we then compare it to our fee, it becomes intolerable.

Therefore, we reason that if you’re in any of these two categories, then moving to Standard Shopping makes sense:

- Spending above $100,000/mo. and seeing no return on Display/Video

- Spending below $100,000/mo. and seeing spikes in Display/Video spend >$2,000/mo.

We’ve moved advertisers from P-Max to Standard Shopping in both of these scenarios (resulting in temper tantrums from Google Reps) and have been able to scale the spend without seeing unprofitable spend increases in Display/Video.

The Right Tool for The Right Job

One of the advantages of working only with eCommerce is that I get to work more in-depth with different scenarios of eCommerce.

This has resulted in this article.

I don’t believe that there is one best way to do anything anymore.

I believe that there are tools for the job, and those tools vary over time.

We routinely change campaign structures when we notice the old ones don’t work anymore. That Top Impr. Share vs. POAS example I gave? It used to be a desktop vs mobile campaign split.

We don’t do those anymore.

And you shouldn’t stick to only Performance Max or Standard Shopping.